Tariffs – US Dollar – “Mar-a-Lago Accord”

Uncertainty and US Dollar Weakening Strategies à la “Plaza Accord”

The Plaza Accord (1985) remains a fascinating case study in international economic diplomacy, demonstrating how major economies can collaboratively address systemic economic challenges through coordinated intervention.

The agreement involved the finance ministers and central bank governors of five major economies: the United States, Japan, West Germany, France, and the United Kingdom.

Heiner Flassbeck highlights in a recent blog post with reference to the “Plaza Accord” what a crucial role the exchange rate plays in the current account balances, be it surplus and/or deficit.

This is not hard to observe empirically.

As the dollar appreciated sharply in real terms in the 1980s, the current account slipped deep into deficit. The reversal of the dollar's value following the so-called “Plaza Accord”, a political intervention to devalue the US dollar, brought the American current account balance into balance within a few years.

Even after that, between 1995 and the turn of the century, the dollar again experienced a massive appreciation. The American current account deficit again increased, reaching a record high of over 6% of GDP before the global financial crisis of 2008/2009.

Since 2020, the US current account deficit has again increased sharply. The real exchange rate of the US dollar rose by more than 30% after the financial crisis and, particularly after 2020, increased by another 10%.

In this respect, the considerations of a political action similar to the “Plaza Accord” (“Mar-a-Lago Accord”), which aims to devalue the US dollar and reduce the American current account deficit, cannot be dismissed.

At the time, the US dollar was extremely strong, reaching unprecedented high levels that were causing significant economic imbalances.

The strong dollar was hurting US manufacturing sector by making American exports much more expensive.

The accord's primary goal was to deliberately depreciate the US dollar against the Japanese yen and German deutsche mark (*).

The Reagan administration and Treasury Secretary James Baker were primary architects of the accord. Their motivations were multifaceted:

Reduce trade deficits

Support US manufacturing

Create more balanced international trade relationships

Demonstrate effective international economic diplomacy

Today, it is US President Donald Trump and Treasury Secretary Scott Bessent who are pointing out identical imbalances.

While global economic conditions are different now, there are some parallels that might suggest the potential value of a similar coordinated approach:

Persistent trade imbalances between major economies

Significant currency valuation disparities

Complex interdependencies in global financial markets

However, a modern equivalent would face more complex challenges:

More multipolar economic landscape (inclusion of China, emerging markets)

More sophisticated and interconnected financial markets

Different global economic structures compared to the 1980s

Greater complexity of international trade relationships.

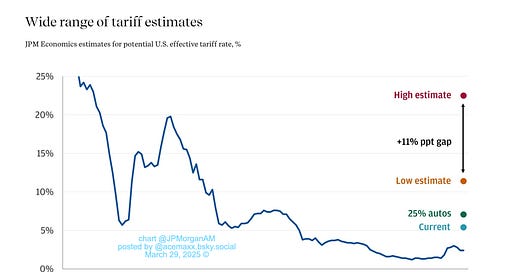

Sure, the persistent overvaluation of the USD poses a challenge, but the “Mar-a-Lago Accord” and «user fees» on reserve assets carry substantial risks, notes JPMorgan AM in a recently published research.

Most notably, these measures could undermine the dollar’s reserve status and lead to much higher long-term interest rates, which are also contrary to the administration’s goals.

Further, it seems unlikely that other economic policymakers would agree readily to a scheme to weaken the dollar like they did in the 1980s.

At present, economic experts’ opinion are mixed. Some argue that while a direct replication isn't feasible, the spirit of coordinated, multilateral economic management remains valuable.

(*) Japanese and German Perspectives:

Japan was particularly concerned about the rapid currency appreciation.

Japanese exporters like Toyota, Sony, and other major manufacturers saw their international competitiveness dramatically erode. West Germany was more ambivalent but ultimately saw the strategic value of cooperation.

PS: Heiner Flassbeck’s new book «Grundlagen einer relevanten Ökonomik» Westend Verlag (Sept 2024) will soon be published in English.