Why ECB Risks Reinforcing Disinflation

The Rise in Real Yields May Constrain Growth

Today I will try to figure out, using a recent chart from JPMorgan AM, what is driving the yield on German 5-year government bonds this year.

Let’s take the following data from the chart:

Nominal 5y Bund yield: –10bp

Inflation expectations (break-even inflation): –13 bp

Real yield (nominal minus inflation expectations): +5 bp

What this tells us:

1. Inflation expectations are falling

A 13bp drop in 5y breakeven inflation means the market expects lower inflation over the next 5y than it did at the start of the year.

This aligns with broader euro area disinflation data - inflation is retreating faster than many central banks (especially the ECB) expected.

2. Nominal yields fell, but not by as much

Nominal yields (the headline Bund yields) only fell by 10bp, which is less than the fall in inflation expectations.

That implies that real yields (i.e., the inflation-adjusted return) have actually risen.

3. Real yields rising = tighter financial conditions

A +5bp increase in real yields signals that monetary policy remains tight - or is even tightening in real terms, despite nominal cuts (like the ECB’s June rate cut).

Investors are demanding more real return to hold government bonds, which reflects either:

Fading inflation fears, or

Weakening growth expectations, which lower the demand for risk.

Key insights

Markets expect subdued inflation - perhaps even too subdued, which might challenge the ECB’s credibility on its 2% inflation target.

Financial conditions are not easing much in real terms - despite nominal rate cuts.

The rise in real yields may constrain growth if it discourages borrowing and investment.

Bottomline

This subtle shift - lower inflation expectations with higher real yields - could become a policy dilemma.

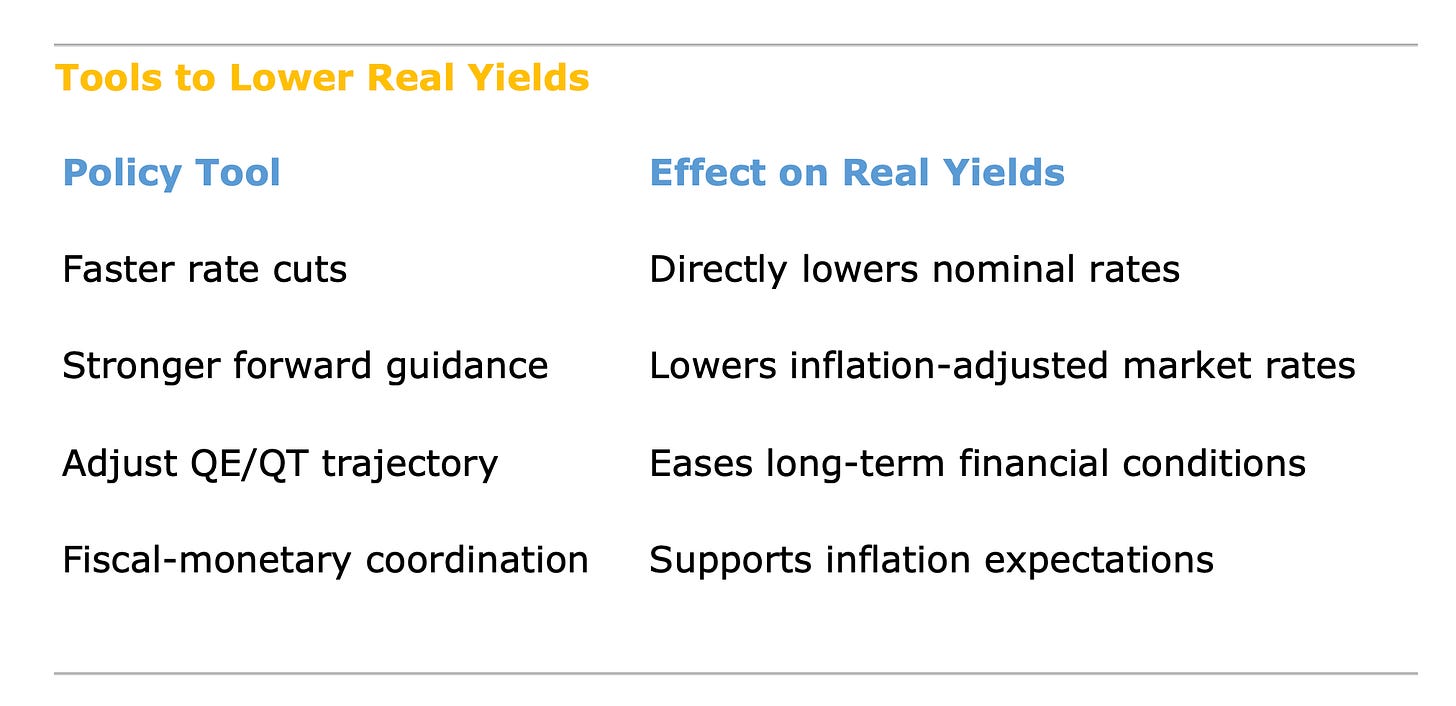

If the ECB doesn’t respond with clearer forward guidance or further easing, it risks reinforcing the disinflationary path, leading to persistent inflation undershooting, exactly what we discussed in the earlier posting.