FT Alphaville draws out attention to a working paper published by the European Central Bank (ECB) on the repo market.

repo markets have become more collateral-driven, involving diverse nonbank financial players and trading motives;

banks’ intra-group transactions form a large share of non-centrally cleared volumes;

haircuts, even for riskier collateral, are often zero or negative, especially in euro trades.

Say again!

Repo haircuts zero or negative?

This is quite striking and can be explained by several interconnected factors in modern repo markets:

The basics: What Is a Repo?

A repurchase agreement (repo) is a short-term collateralized loan:

The borrower sells a security (typically bonds) with an agreement to buy it back later.

The lender holds the security as collateral.

A haircut is applied - usually the lender lends less than the full market value of the collateral.

So what does it mean when haircuts are zero or negative?

It means lenders are giving cash equal to or more than the value of the collateral. In some euro repo markets, this is not rare - especially for sovereign bonds.

Main Causes

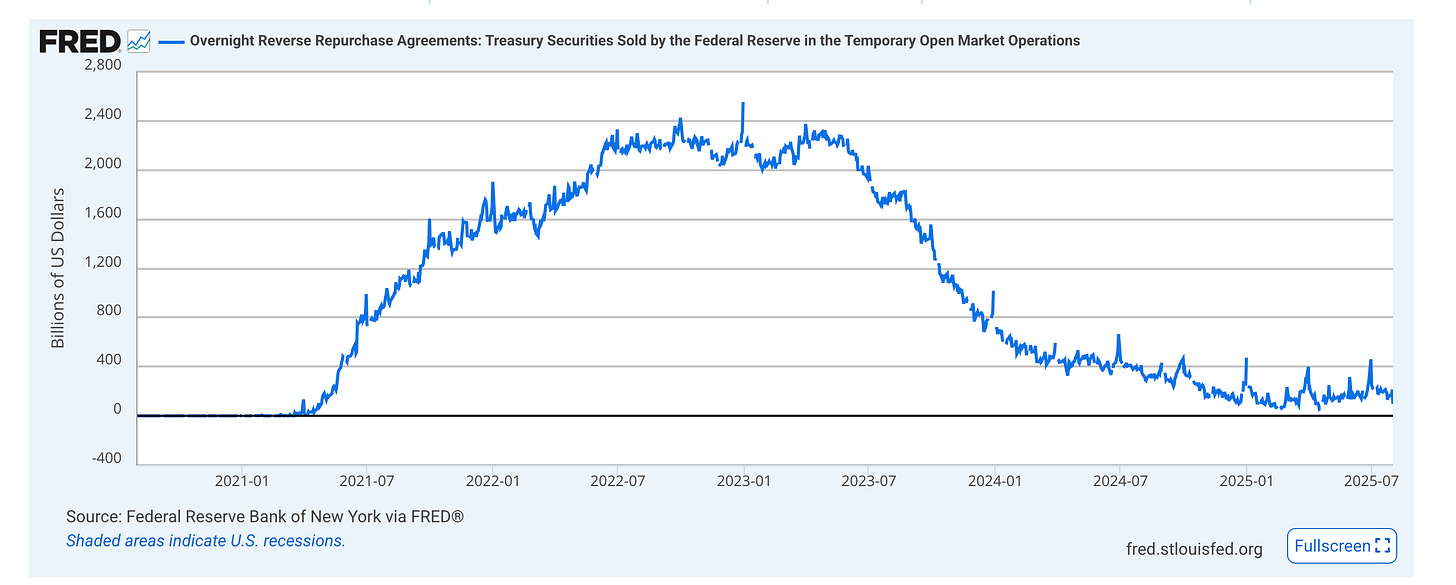

Excess liquidity and safe asset scarcity

Euro area flooded with cash due to ECB quantitative easing (QE).

High demand for safe collateral (like German Bunds) means lenders compete to hold them - even at a premium.

Collateral re-use (Rehypothecation)

In European markets, collateral is often re-used.

This increases its perceived value and reduces the need for a haircut.

Regulatory and reporting pressures

Banks need high-quality collateral to meet regulatory requirements (LCR, NSFR).

Around quarter-ends, demand spikes for balance sheet optimization - leading to distorted repo pricing.

A «low» Interest rate environment

Holding cash is costly.

Lenders prefer slightly overvalued securities to parking idle cash at negative rates.

Dealer competition

Large banks and dealers may offer very favourable terms to key clients to keep business - even at the cost of a negative haircut.

Bottom Line

Zero or negative haircuts reflect a complex environment of excess cash, collateral scarcity, regulatory incentives, and distortions from monetary policy - not irrational behaviour.