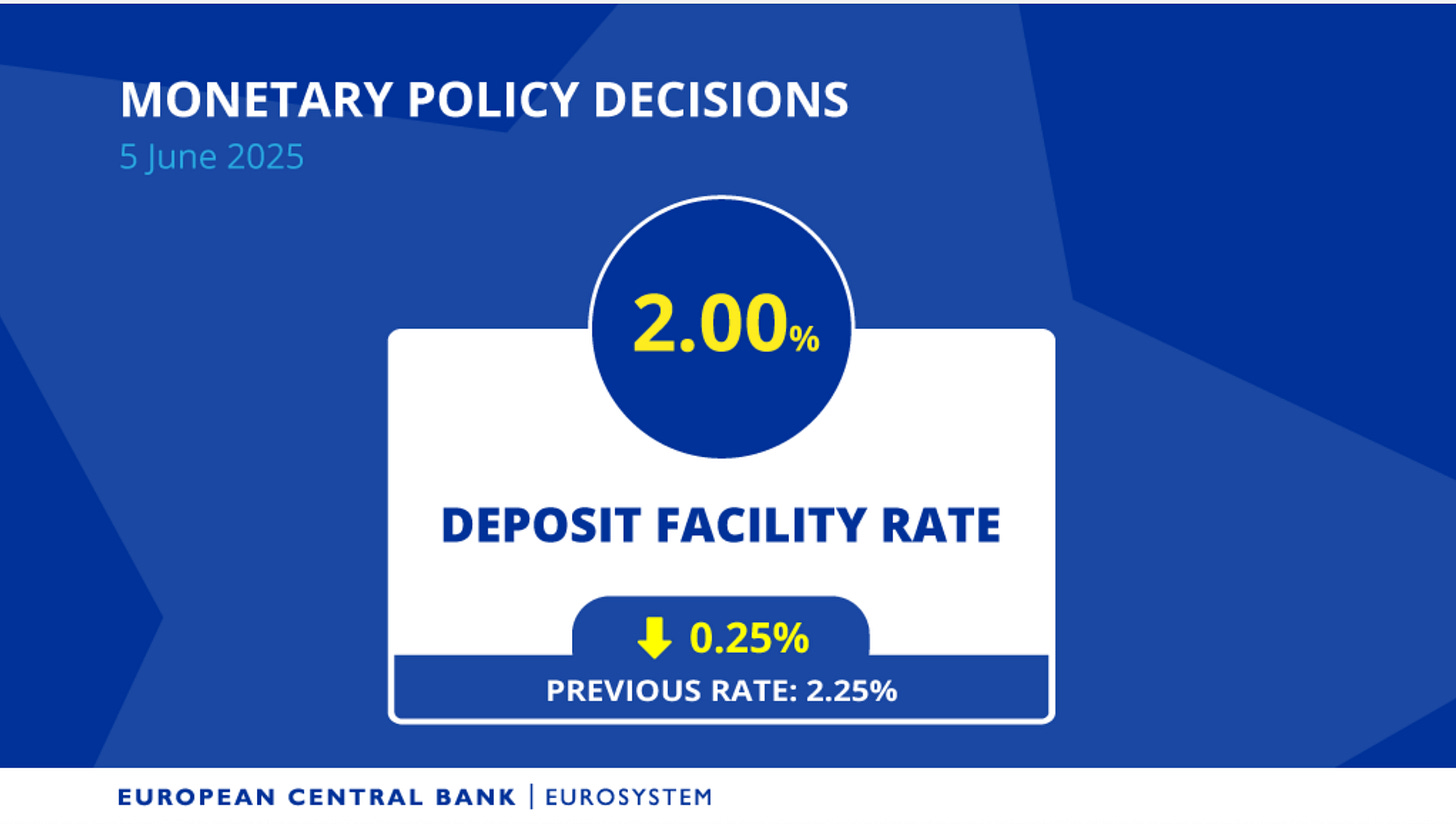

The Governing Council Thursday decided to lower the three key ECB interest rates by 25 basis points.

In particular, the decision to lower the deposit facility rate – the rate through which the Governing Council steers the monetary policy stance – is based on its updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission.

The ECB has a 2% symmetric inflation target. Forecasting 1.6% in 2026 suggests:

They expect to undershoot their own target

Yet they are cutting rates only cautiously

And they still expect only modest growth (i.e., no overheating)

This doesn’t square with their supposed data-dependent and target-seeking approach.

Normally, central banks should ease more aggressively if they forecast long-run inflation below target.

Low Growth + Tight Labor Markets = Disinflation?

Their forecast implies:

Weak growth (~1.1%)

Labor markets holding up (unemployment stable)

But inflation dropping sharply below 2%.

That’s hard to reconcile unless they’re assuming:

Structural slack in the economy (e.g., from immigration or productivity rebound)

Or strong disinflation from goods/services trade, energy, or a strong euro

Still, forecasting 1.6% inflation in 2026 with rates still at 2% seems overly optimistic about disinflation forces.

If inflation is falling below target, shouldn’t the ECB cut more aggressively?

If growth is improving only slowly, why keep policy mildly restrictive?

This forecast may be trying to thread the needle — to:

Justify Yesterday’s rate cut

Avoid spooking hawks

Keep credibility intact

But it may confuse markets looking for a clearer signal about the rate path.

Bottomline:

The ECB is cautiously easing, but forecasts are politically loaded.

They want to ease, but are wary of over-promising in case inflation rebounds

So they produce forecasts that justify mild easing but avoid committing to a full-blown pivot

The 1.6% forecast for 2026 is probably there to show they are serious about their mandate, but the assumptions behind it feel contrived or convenient.

In short:

This looks more like a calibration exercise than a purely data-driven forecast.