On October 8th, 2025, the price of gold has exceeded the $4,000 per troy ounce (31.1 grams) mark for the first time in history, rising by more than 50% since the beginning of the year.

This is remarkable.

The reasons commonly cited by analysts are versatile. Yet despite all the good explanations, one should not be surprised that there have been difficult times in the past with severe stock market crashes and more. But the price of gold has never been so high.

The question is what do movements in that price tell us today?

Gold is not a simple “inflation hedge” anymore: it seems to be a confidence barometer for the entire global monetary order.

Gold has no yield, so its price reflects the opportunity cost of holding it versus other safe assets.

The key variables are:

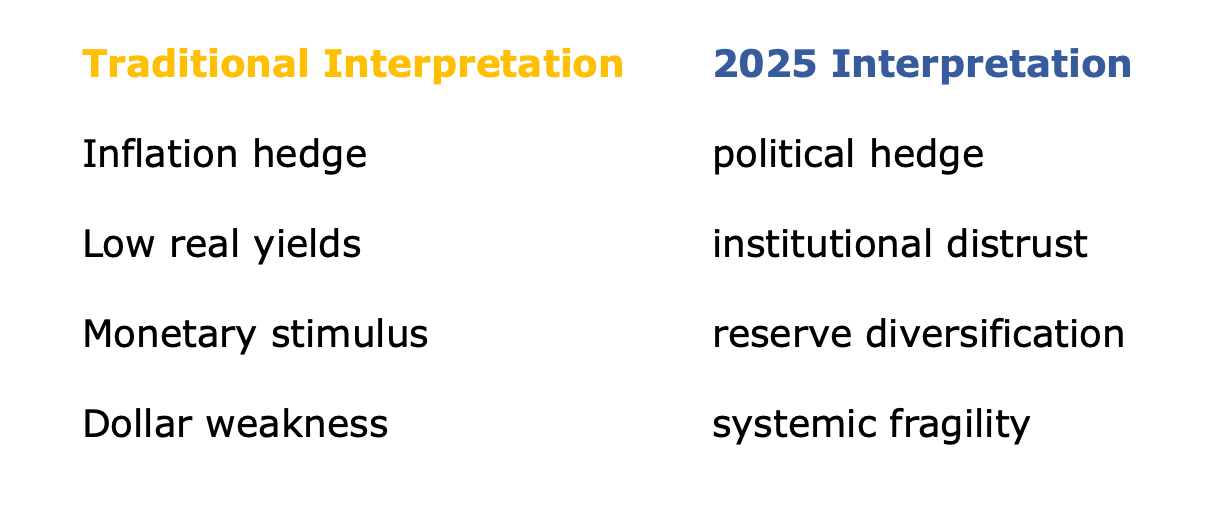

Why the current surge (to $4,000) is different:

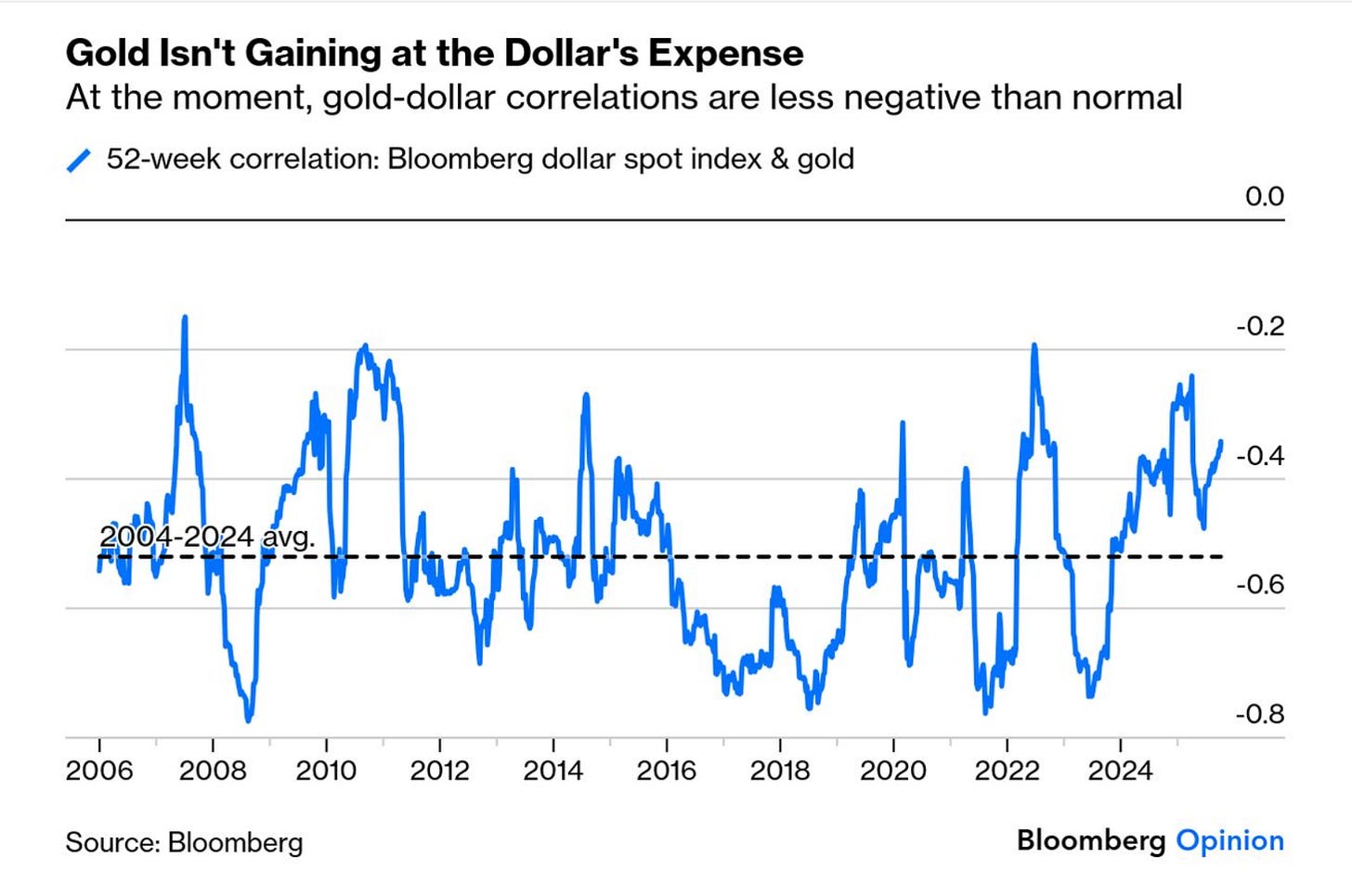

real rates are not falling, and inflation expectations are relatively stable.

So this rally cannot be explained by the textbook “real yield” model. Instead, several geopolitical and structural forces are driving it:

A crucial parameter is central bank diversification:

Over the past 3 years, emerging and even middle-income central banks (notably China, India, Türkiye, and several Gulf states) have been buying record amounts of gold, reducing exposure to US Treasuries.

The motivation: distrust of US financial sanctions, weaponization of the dollar, and political risk in Washington.

In essence, they view gold as geopolitically neutral collateral — something Washington cannot freeze.

Erosion of confidence in US institutions

If the Trump administration politicizes the Bureau of Labor Statistics (BLS) or interferes with the Fed, investors may lose faith in the reliability of US data and in the credibility of “risk-free” instruments like TIPS.

That undermines confidence in real yields as a trustworthy signal — pushing capital toward hard assets.

Fiscal and debt concerns

The US federal deficit remains above 6% of GDP, debt-to-GDP above 120%.

Markets may be starting to question whether the US can sustain this debt load without financial repression or inflationary tactics down the line.

Global fragmentation

The weaponization of finance (sanctions, SWIFT restrictions) has led to a gradual de-dollarization trend: BRICS and other states increasingly seek alternative payment and reserve assets.

Gold is the one asset with no political counterparty risk.

So what do movements in gold now tell us?

Gold’s surge no longer primarily reflects inflation fears — it reflects institutional distrust and geopolitical reinsurance.

In effect, the world is insuring itself against US political instability and financial dominance.

At $4,000/oz, the message is less “we expect inflation” and more “we no longer trust the referee.”

What gold is signaling

The “world losing faith in America” question

That’s perhaps too strong if taken literally — Treasuries are still the largest, most liquid safe asset.

But yes, confidence in the neutrality and predictability of US economic governance is eroding, and gold’s record price is one of the clearest market reflections of that.

It’s not about immediate inflation — it’s about the perceived fragility of the dollar-based system if US politics become erratic, fiscal policy undisciplined, or institutions (like the Fed and BLS) politicized.

The bottom line

Gold’s $4,000 price reflects a monetary order under stress:

not runaway inflation,

not low real rates,

but a deepening lack of faith in U.S. political and institutional stability.

In that sense, the world’s flight into gold is a vote of hedged distrust toward American governance and the dollar system, not toward the concept of money itself.