US Tariffs versus Germany’s Neo-Mercantilist Model

US is the biggest absorber of global surpluses

US President Donald Trump announced the introduction of high tariffs Wednesday evening. The steep “reciprocal” tariffs on a range of trading partners are likely to place a heavy burden on American consumers and start to impact global economic activity and inflation.

And there is no place to hide: even the uninhabited Heard and McDonald Islands get a 10% tariff.

JPMorgan Chase said it expects US economy to fall into a recession this year after accounting for the likely impact of tariffs announced this week by the White House.

Yet Trump Administration’s policy measures only considers trade in goods, while ignoring trade services.

Furthermore, regardless of how the majority of mainstream-economists comment on the new tariff policy and the somewhat unusual formula used for it, one important, if not the most important, point stands out throughout the White House fact sheet:

«Countries including China, Germany, Japan, and South Korea have pursued policies that suppress the domestic consumption power of their own citizens to artificially boost the competitiveness of their export products. Such policies include regressive tax systems, low or unenforced penalties for environmental degradation, and policies intended to suppress worker wages relative to productivity.»

Yes, it is of the utmost importance to remember that in a long essay (2005) that is still well worth reading, Heiner Flassbeck pointed out how German wage policy was undermining the European Monetary Union (EMU) at that time in order to increase its own competitiveness at the expense of the other EMU member countries.

After the introduction (1999) of the euro (*), German economic policy exerted massive political pressure on the trade unions to reduce unit labor costs, which led to a significant improvement in German competitiveness within the just founded EMU.

The situation was worsened by the inability of euro zone member states to resort to devaluation given the specific feature of the euro as a shared currency.

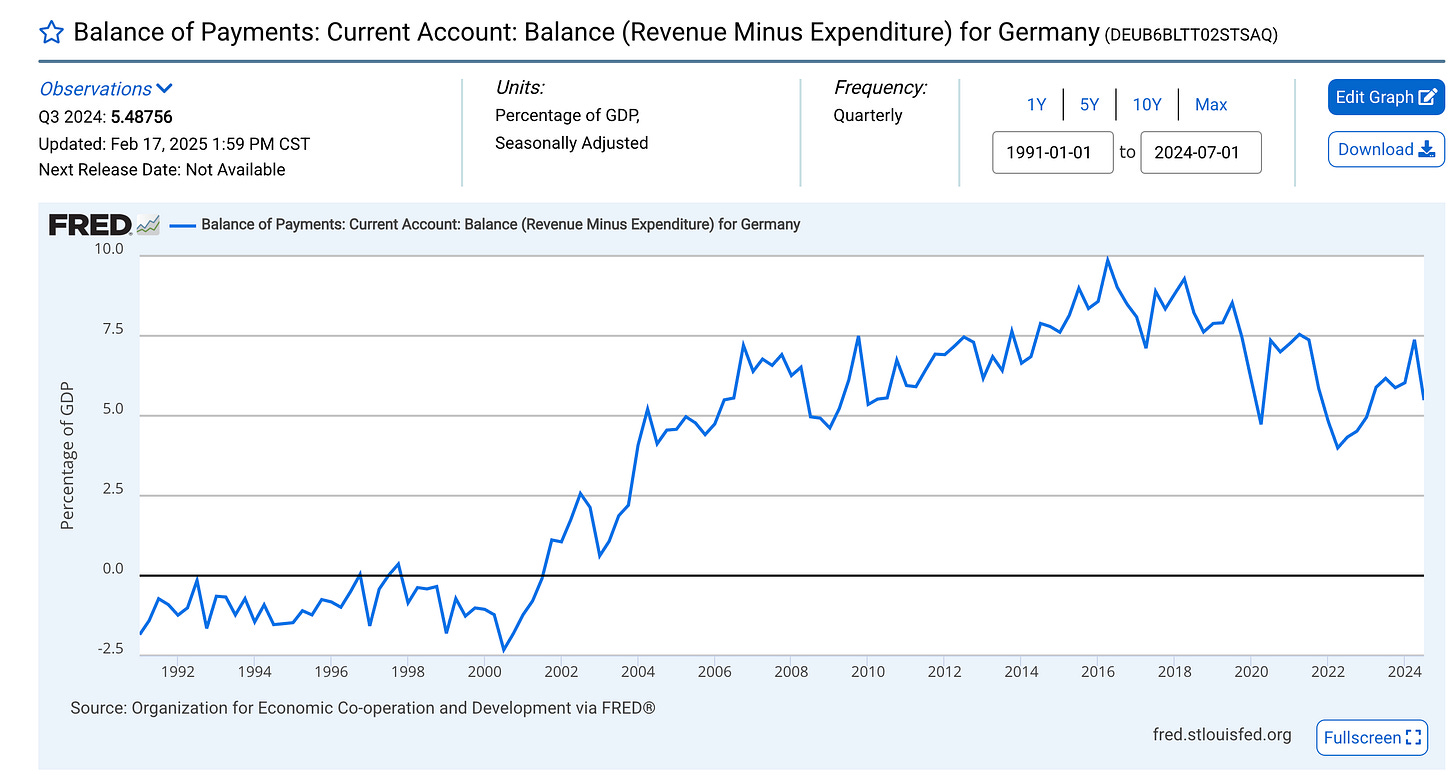

In 2018, attacked by US President Donald Trump, German Chancellor Angela Merkel did defend humongous (**) German current account surplus – (for a while 8% of the GDP) in the following way:

“And of course, the trade surpluses show that our products are in demand. And we naturally want that to remain so in the future.”

The basic tone was that everyone in the euro area should have a surplus. Yet, since the trade surpluses and deficits of all countries must add up to zero, this is obviously not possible. At the aggregate level of the economy, income equals expenditures.

In his recently published excellent book (“Kaputt”), Wolfgang Münchau precisely underlined this simple fact and added that world politics is turning against the German model.

There are certainly several ways to evaluate the US administration's new tariff policy. But this one is certainly not wrong.

The bottom line is that we (nolens volens) now more or less observe Trump’s tariffs versus Germany’s neo-mercantilist export-led industrial model (without wage increases).

(*)

The euro coins and banknotes were introduced on January 1, 2002 and the largest cash changeover in history took place in 12 EU countries.

(**)

Germany has thus also violated EU rules

(a) Germany has violated the mutually agreed inflation target by undermining it through wage cuts.

(b) Article 109 of the Constitution (“Grund Gesetz): “take account of the requirements of macroeconomic equilibrium”

Paragraph 1 of the Stability and Growth Act of 1967:

“The Federal Government and the Länder shall take account of the requirements of macroeconomic equilibrium in their economic and fiscal policy measures”.