US Policy Uncertainty and USD Selling Pressure

EURO: cheaper issuance + cheap currency swap = funding advantage

It’s an open secret that policy uncertainty - especially in the US - can trigger massive movements in currency markets, particularly involving the US dollar.

The uncertainty primarily concerns the following areas:

US fiscal policy (e.g. debt ceiling drama, deficits)

Monetary policy (e.g. unpredictable Fed decisions)

Trade or geopolitical policy (e.g. tariffs, sanctions, elections)

When such uncertainty rises, global investors and CBs holding US assets (like UST, corporate bonds, or equities) get nervous.

Now, given US President Trump’s disruptive approach to trade, Morgan Stanley Research predicts that US Dollar Index will “fall about 9% to hit 91 by around this time next year”.

JPMorgan Research also remains bearish on the US currency.

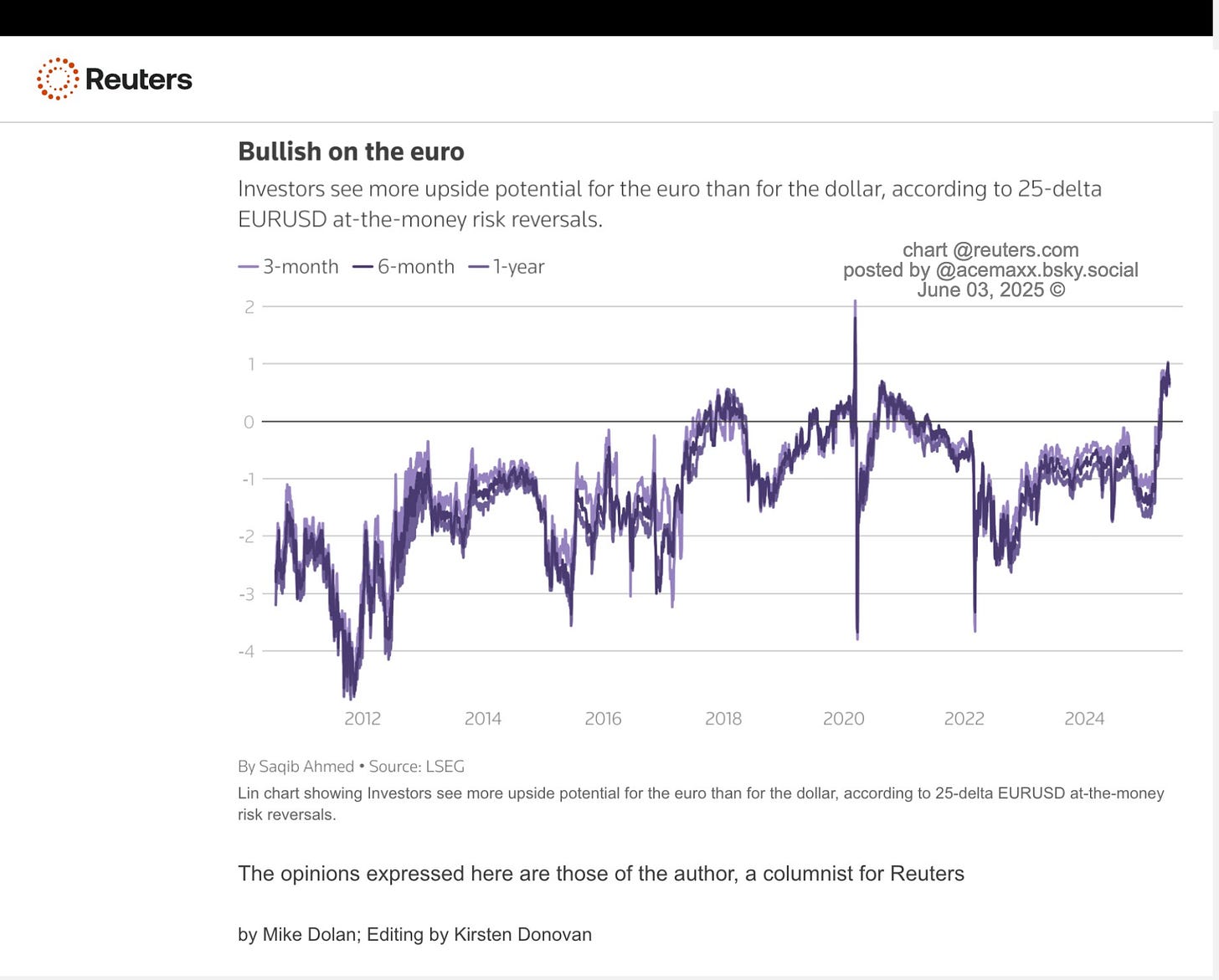

A chorus of voices are considering the euro, yen and Swiss franc as the biggest winners from dollar weakness.

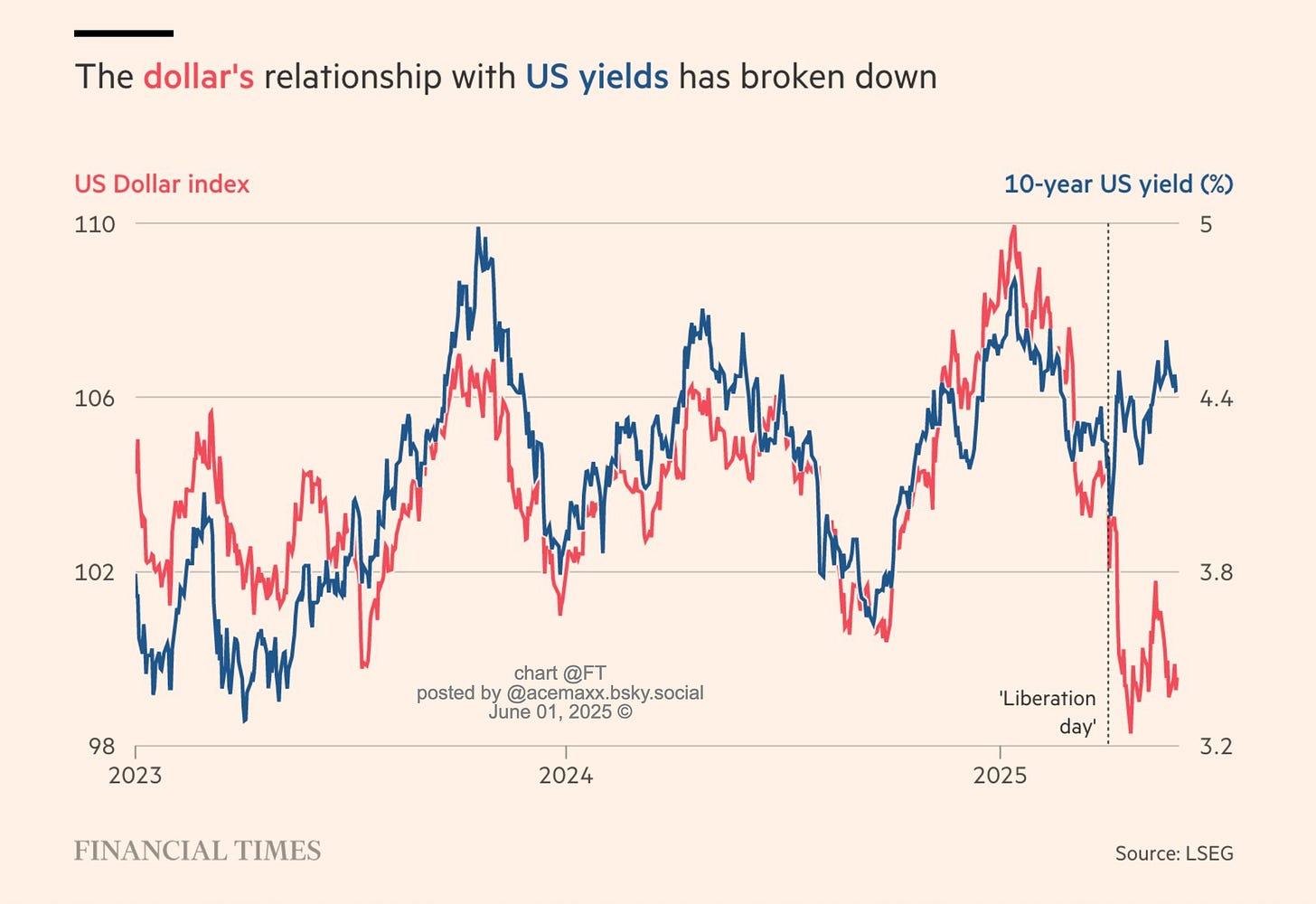

It is also notable that the close relationship between US Treasury yields and the dollar appears to have dissolved as investors turn away from American assets in response to President Donald Trump's volatile policies.

The borrowing cost of Treasury bonds and the value of the currency have tended to move in lockstep in recent years, with higher yields typically signaling a strong economy and attracting inflows of foreign capital.

Yet the correlation between the two has fallen to its lowest level in nearly three years.

The unusually high level of policy uncertainty is prompting investors to increase their hedge ratios.

If hedge ratios rise significantly, the next step, namely selling the dollar, is not far away.

A hedge ratio refers to how much of a position is protected against currency risk.

If a foreign investor owns $100 million in US assets, they’re exposed to the US dollar.

To hedge, they might sell USD forward contracts or use other instruments to reduce exposure to dollar depreciation.

If even a small percentage of these holders decide to increase their hedging, it requires them to sell USD in the FX market (or at least take positions that mimic that effect).

This can weaken the dollar, raise currency volatility, and possibly tighten global financial conditions (since the dollar is the world's reserve currency).

Imagine foreign investors hold $10 trillion in U.S. assets:

A 1% increase in hedge ratios = $100 billion of new USD hedging (i.e., selling USD forward).

That’s a big deal for FX markets, especially in uncertain times.

What is furthermore making the euro market attractive for USD-based borrowers is the increased differential between euro and USD spread which is creating a lower cost of issuance in euro, particularly as the cross-currency basis swap remains at historically very low levels.

And this basis is expected to stay anchored at these very low levels of between 0-5bp, according to a current analysis by ING Economics.

The wide gap between euro and U.S. credit spreads makes it cheaper to issue in euros.

And since the cost of swapping euros into dollars (via cross-currency basis swaps) is currently near zero, the total funding cost in euros (converted to USD) is lower than borrowing directly in dollars.

This makes the euro market attractive for USD-based borrowers — and is expected to remain so, as long as the basis stays near 0–5bp.

This means the cost to convert euro debt into USD remains low, supporting continued issuance in euros by dollar-based borrowers.

U.S. companies may increasingly issue debt in euros to take advantage of lower spreads and near-zero swap costs.

This supports euro credit markets and could compress global spread differentials.

Excellent breakdown. What we’re seeing isn’t just a cyclical dollar retreat—it’s the financial expression of credibility erosion in U.S. policy. When fiscal dysfunction meets geopolitical volatility, the dollar’s “exorbitant privilege” comes under pressure.