The media framing problem: Fiscal Balance vs. Current Account

Two balances we are talking about

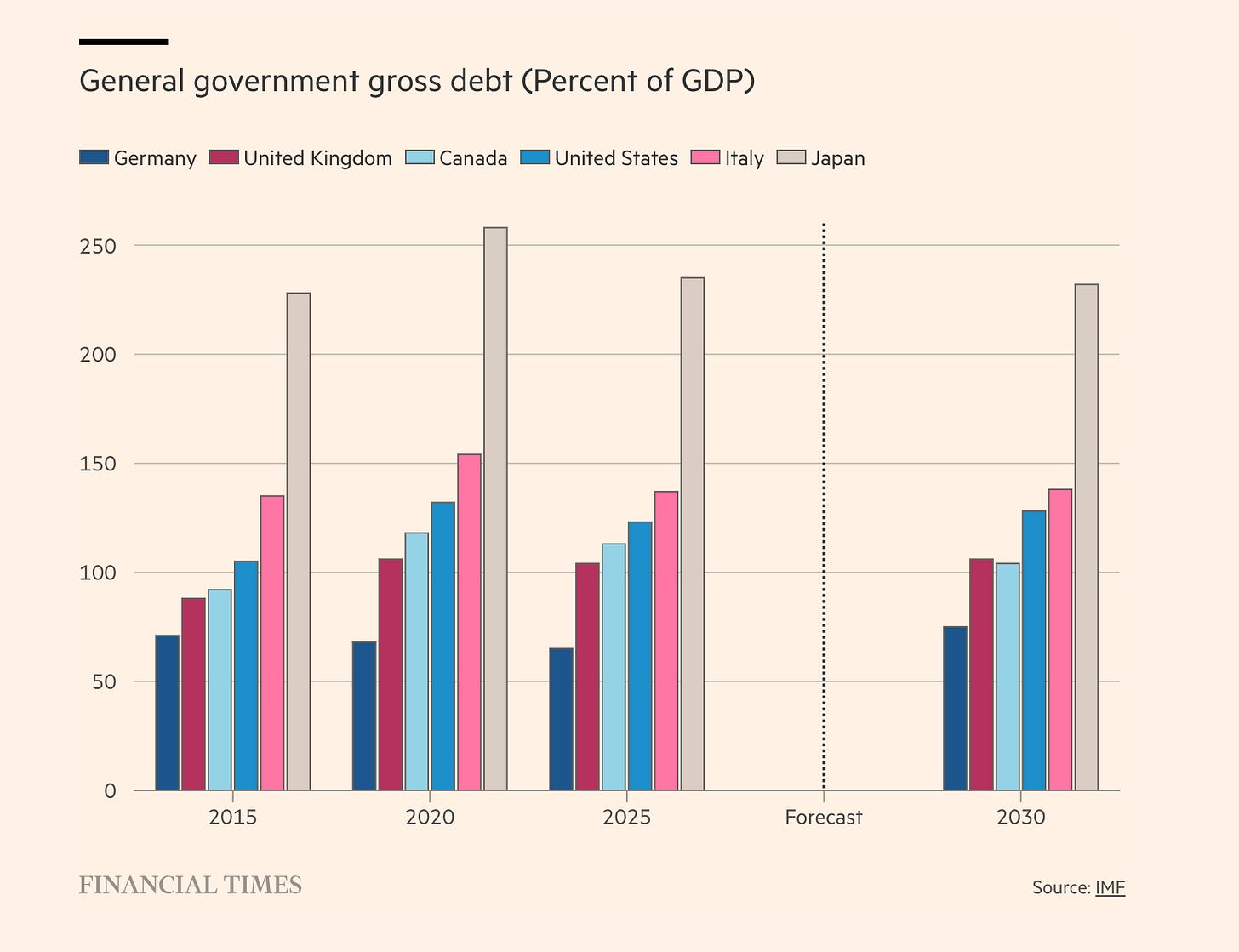

Charts like “net government borrowing in % of GDP” focus only on the public sector and can make Germany look fiscally weaker than it is.

But Germany’s enormous current account (CA) surplus and private savings surplus show that the economy overall is “living below its means.”

In fact, the German Govt’s small deficit is just the offsetting item that balances the private savings + external surplus.

Why it matters for interpretation

Saying “Germany is in deficit” (public sector only) is misleading if you imply the whole country is overspending.

France and the U.S. are different cases: both the government runs a deficit and the current account is in deficit or near balance — meaning the country as a whole is borrowing from abroad.

Germany is unique in that its fiscal deficit is small and outweighed by a huge external surplus.

Two “balances” we are talking about

Fiscal balance (Govt net lending/borrowing) → only the public sector.

CA balance (external balance with the rest of the world) → covers the whole economy (households + firms + government).

So it is perfectly possible for the German Govt to run a small deficit while the German economy overall runs a huge surplus with the rest of the world.

Why this is possible

In 2024 Germany had:

Private sector savings surplus (households + firms) ~ €350bn.

Govt deficit ~ –€100bn (≈ –2% of GDP).

CA surplus ~ €250bn.

This matches the sectoral balances identity:

(Private balance)+(Government balance)+(Foreign balance)=0

→If Germany’s private sector saves a lot, and the rest of the world runs a deficit with Germany (CA surplus), then the Govt can still run a deficit and the country as a whole is not “living beyond its means”

In plain English:

Germany’s government may run a modest deficit, but Germany as a nation is still saving massively and exporting capital abroad.

It is not living beyond its means — in fact, it is living below them, because German households and firms consistently save more than they invest at home.

Conclusion

Germany is not living beyond its means. It is asking others to do so. The Chancellor’s call for more savings at home ignores the simple arithmetic of sectoral balances: if Germany saves more, someone else must borrow more.

A sustainable economic policy would recognize this interdependence, rather than clinging to misleading metaphors of household thrift. The risk otherwise is clear: stagnation at home, conflict abroad, and a euro area trapped in a spiral of imbalances it cannot resolve.

If there were only one talkshow getting this point...