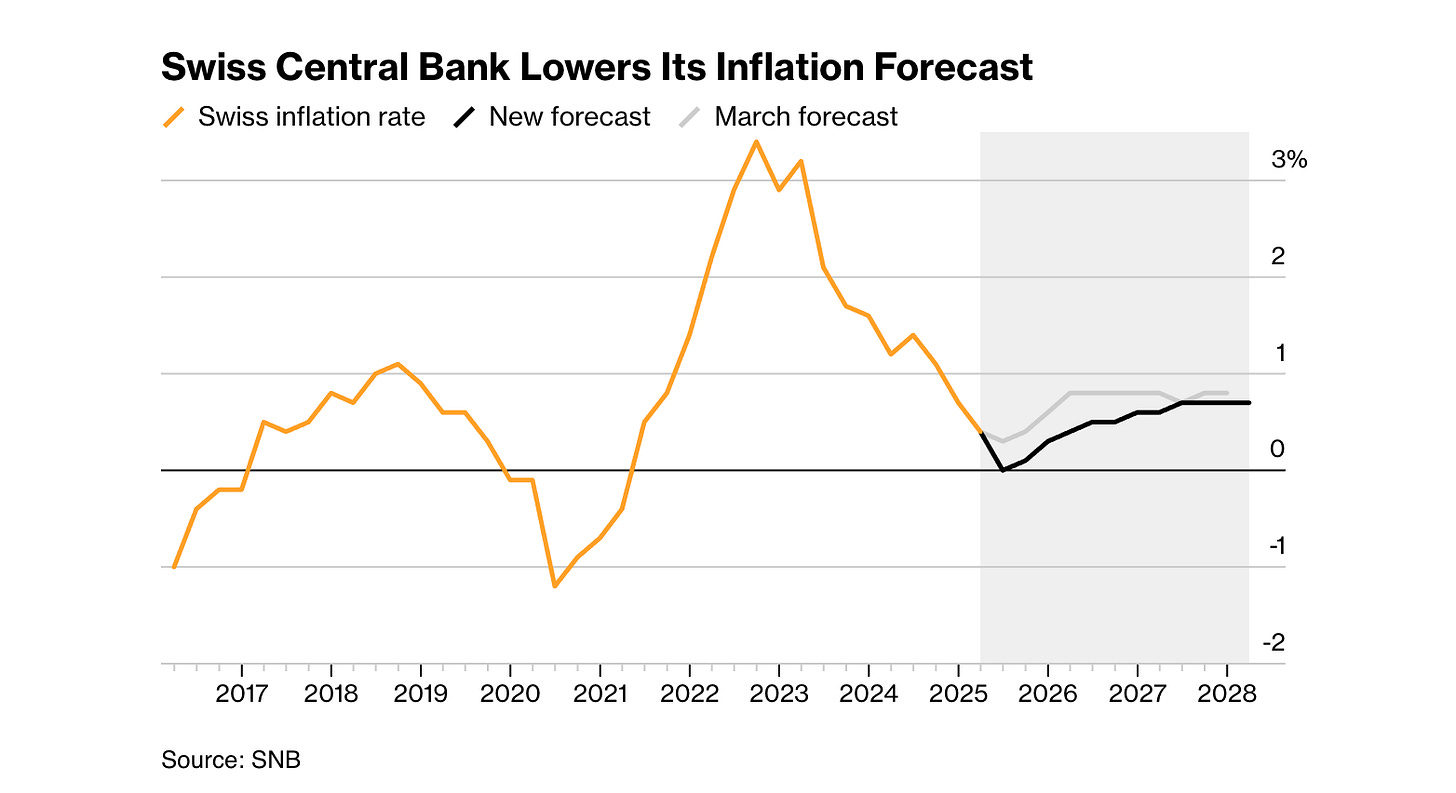

On Thursday, the Swiss National Bank (SNB) has cut policy rate by a 0.25% to zero. The cut came after annual inflation in Switzerland dipped to minus 0.1% in May. Yet the central bank did not go so far as negative rates.

FX traders are now putting a 40% chance that the SNB would cut again to minus 0.25% by March next year.

Switzerland first introduced negative interest rates in December 2014, when the SNB set the deposit rate at minus 0.25% to stem the franc’s appreciation amid safe-haven inflows.

Against this background, Lizzy Burden hit the nail on the head when she said on Bloomberg TV that the Swiss franc is increasingly perceived not as a currency, but as a safe haven.

An excellent insight - and she is absolutely right:

Swiss franc (CHF) is increasingly treated by markets not just as a currency for trade, but as a safe asset - much like gold or high-grade sovereign bonds.

This has important implications, especially now that the SNB is edging back toward negative rates.

In financial markets, a “safe asset” is something investors rush to during times of uncertainty, not for its yield, but for its stability, liquidity, and trustworthiness.

🇨🇭

Here is, why CHF fits the safe-asset profile:

Political stability (neutrality, strong institutions)

Low inflation, strong fiscal discipline

Deep, reliable financial infrastructure

Credible central bank (SNB)

Tradable at scale in global markets

Even with negative rates, CHF is still in demand during global shocks - not for income, but for capital preservation.

And the main implications for the financial markets certainly relate to capital flows.

Demand for CHF rises in crises.

This drives CHF appreciation, even if SNB cuts rates - undermining their monetary easing goals.

With this in mind, it looks like the SNB trapped in a “safe haven paradox”.

The more stable Switzerland looks, the more capital flows in during global turmoil.

Hence, the SNB is forced to defend competitiveness by cutting rates or intervening - often reluctantly.

Furthermore, it’s startling to observe that negative interest rates do not dampen demand.

Like German Bunds or U.S. Treasuries, CHF assets can offer negative returns and still attract buyers.

This turns CHF into a “store of value” rather than a growth or return-generating tool.

Yet there are some market distortion risks. Namely, CHF safe-haven status applies to:

Carry trades (borrowing CHF to fund riskier assets)

Real economy investment decisions

Sovereign FX reserves allocation

SNB may keep rates ultra-low not only due to domestic inflation, but to offset CHF's safe-asset pull.

Potentially, this can dampen Swiss bank profitability, real estate bubbles, or external imbalances.

The new downward revision of inflation forecasts for 2025 and 2026 signal that the SNB with interest reduction step is probably not yet at the end.

Unless the geopolitical environment changes significantly, e.g. via a very strong increase in the price of oil products in Switzerland.

Bottom-line

Thursday's decision appears to pave the way for another rate hike in September and a return to negative interest rates.

Although the SNB recognizes the adverse effects of negative interest, it cannot avoid going in this direction if it has no other option.

It should also be noted that the SNB no longer describes the Swiss franc exchange rate as “significantly overvalued” or “highly valued”.

This means that it will probably refrain from intervening in the FX market in favour of the CHF for the time being, especially as the Swiss central bank would like to avoid being branded a “currency manipulator” by Washington.

As the Swiss franc evolves into a global safe asset, financial markets treat it more like a bond or gold than a medium of exchange. Even negative interest rates won’t fully stem its demand in times of stress. This complicates monetary policy for the SNB - and creates ripple effects across global FX, bond, and capital markets.