SNB and Remuneration of Sight Deposits

A Swiss-technical monetary policy tool

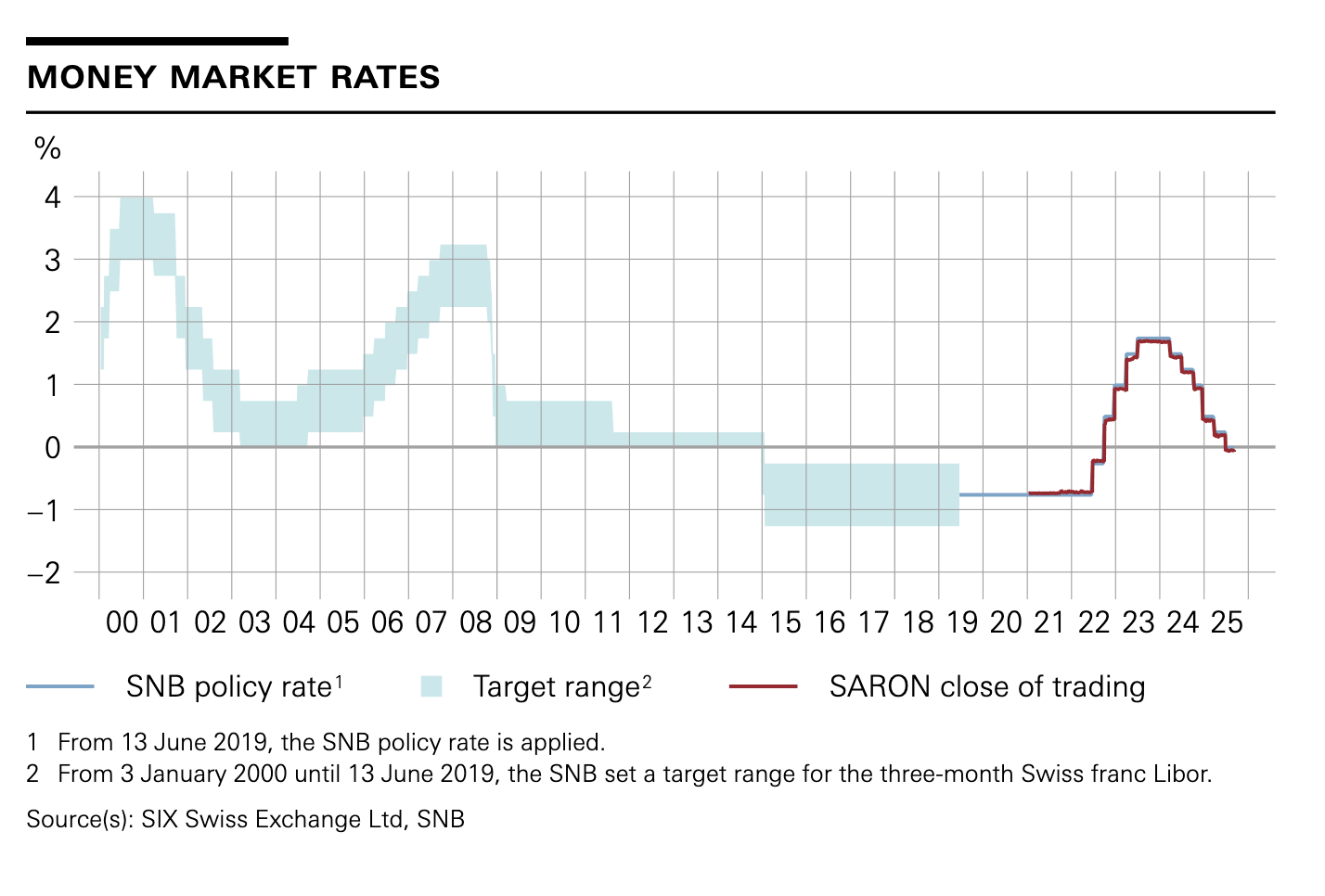

After six consecutive rate cuts, SNB said on Monday in a statement that it is lowering the threshold factor for the remuneration of sight deposits of account holders (subject to minimum requirements) from 18 to 16.5, effective as of 1 November 2025.

What is about?

This is one of those Swiss-technical monetary policy tools that looks obscure but matters for CHF liquidity and money market rates.

What are sight deposits at the SNB?

Swiss banks hold deposits at the SNB (like “reserves” at the Fed/ECB).

These sight deposits are partly required (minimum reserves) and partly “excess” (above what regulation requires).

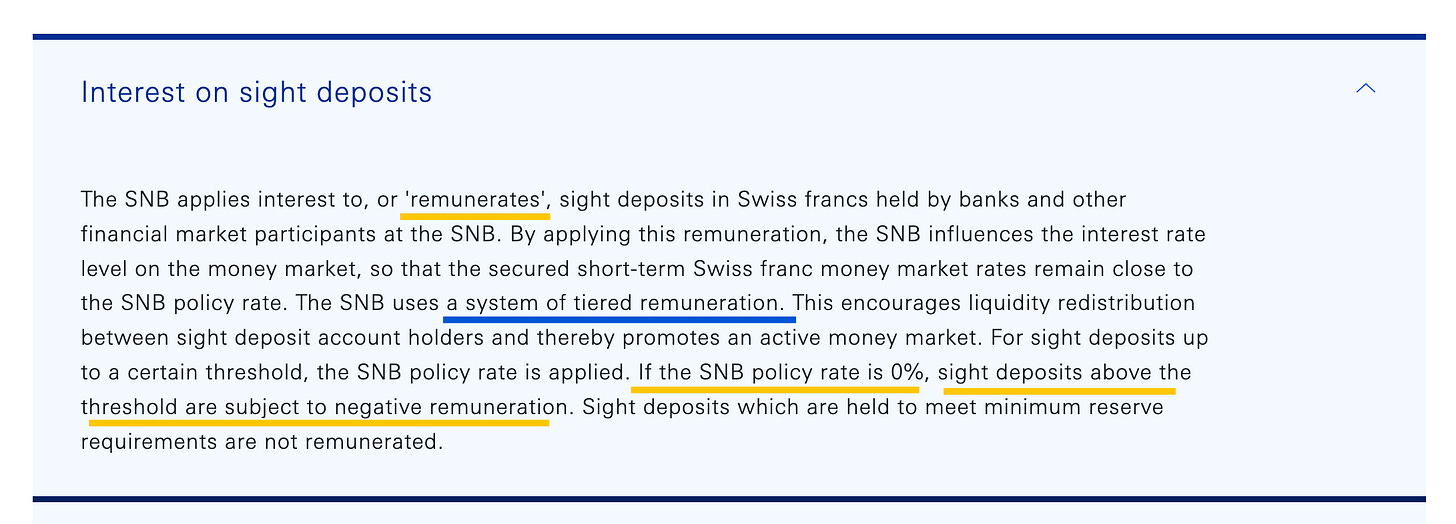

The SNB pays interest on these deposits — but not equally for all of them.

What is the threshold factor?

The SNB defines a “threshold” = a multiple of each bank’s minimum reserve requirements.

Example: if a bank must hold CHF 1bn as minimum reserves, with a threshold factor of 18, its threshold = CHF 18bn.

Up to that threshold, the SNB pays the policy rate on reserves.

Above that threshold, reserves are remunerated at a lower rate (or zero).

So the threshold factor is basically how generous the SNB is in paying interest on reserves.

What does “lowering the threshold from 18 to 16.5” mean?

Banks can now only earn the full policy rate on 16.5 × their minimum reserves (instead of 18 ×).

This reduces the amount of deposits that earn full interest.

Put differently: a larger share of banks’ reserves will now earn a lower rate (or nothing).

What are the consequences?

For banks: It raises the “cost of holding excess reserves” → nudges them to use that money more productively (lend, buy securities, or reduce deposits).

For the money market: This tightening of remuneration should put slight downward pressure on sight deposits and slight upward pressure on short-term CHF market rates (since banks prefer lending money in the market rather than holding non-remunerated reserves).

For the CHF: By making CHF liquidity a bit less attractive, it could weaken the franc at the margin (since holding CHF sight deposits earns less).

But if markets interpret this as the SNB being cautious about deflation and reducing policy accommodation, it might strengthen CHF in the short run.

Net effect depends on how markets read it: usually, lower thresholds = mildly dovish signal (more liquidity push), so slight depreciation pressure on CHF.

Bottom line (in plain terms):

SNB just made it less attractive for banks to hoard cash at the CB. This should push some liquidity into the market, nudge money-market rates a little higher, and probably ease the Swiss franc a touch … unless investors interpret it as the SNB trying to fight deflation, in which case it could have the opposite effect.