In response to FT’s question “Should China adopt a zero interest rate?” (FT View, July 17): I had like to say that this is not necessary.

Unlike many Western economies, China retains significant fiscal space at the central government level. Public debt at that level remains low, leaving room for meaningful fiscal stimulus.

According to textbook macroeconomics (Econ 101), when a country runs a persistent current account surplus, the appropriate way to restore internal and external balance is not necessarily through monetary easing, but through fiscal expansion.

In this case, increased government spending can stimulate domestic demand and help reduce excess savings, thus addressing both weak nominal growth and structural imbalances in the external accounts.

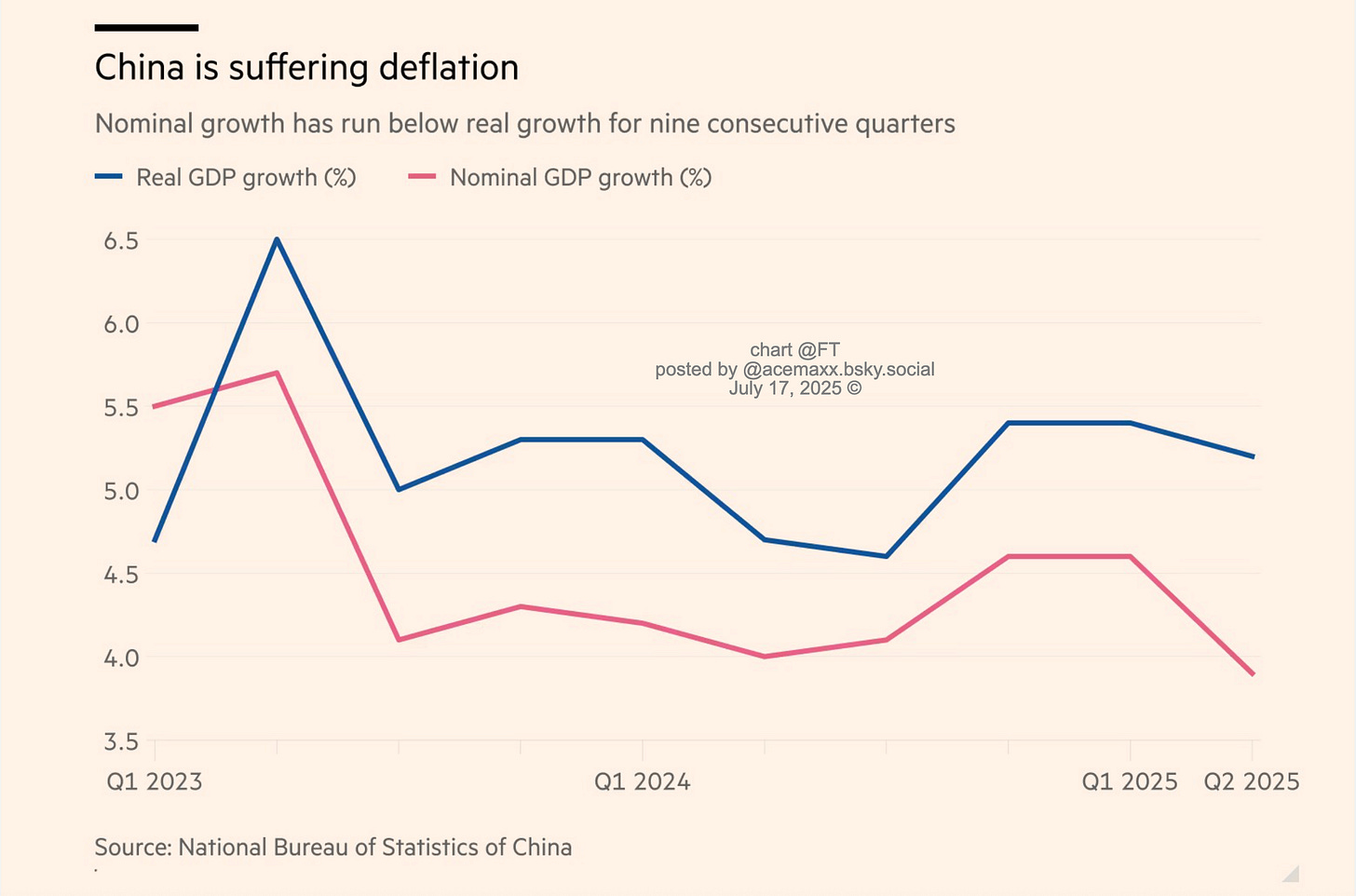

China’s 2Q2025 data illustrate the dilemma well.

Real GDP growth was a respectable 5.2%, but due to falling prices, nominal growth lagged behind at just 3.9%. This divergence implies that real interest rates remain elevated - even if nominal policy rates seem low - exerting deflationary pressure.

Still, rather than pursuing Western-style zero interest rates, Beijing would be better served by proactive fiscal policy and structural reforms that boost consumer confidence and productivity.