Reverse Yankees and FX-Markets

Capital Account Flows Appear Strong for the Eurozone

In fixed-income markets, "reverse Yankee" deals refer to debt issued in euros (or another foreign currency) by US-based companies - typically in Europe.

A "Yankee bond" is a US dollar-denominated bond issued in the US by a foreign company.

A "Reverse Yankee" flips this: it's a foreign currency bond (usually euros) issued in Europe by a US company.

Financial Times (FT) London reports:

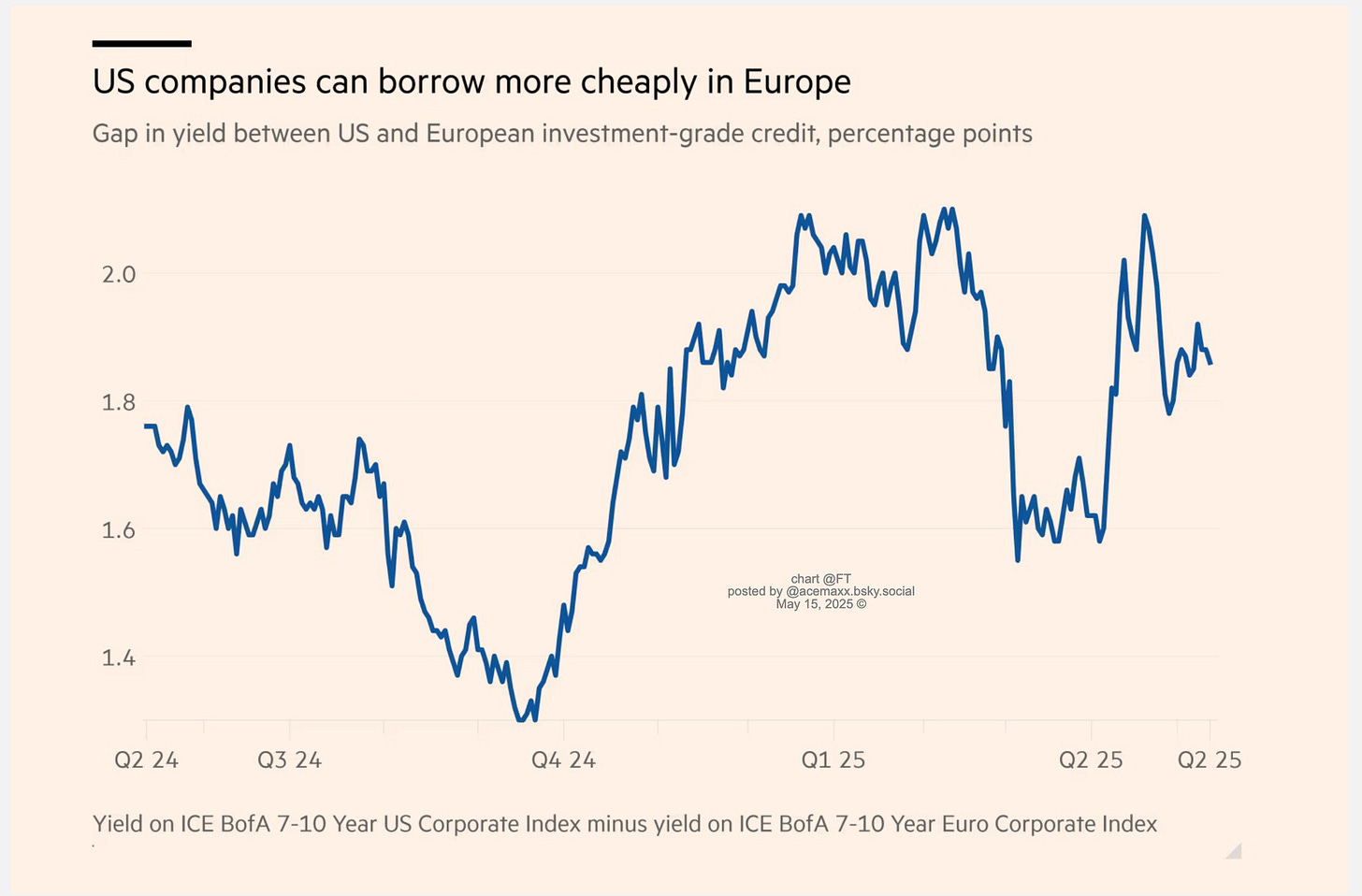

«US companies are tapping Europe’s debt market at a record pace, attracted by lower borrowing costs on the continent and the chance to diversify their sources of funding»

The amount in so-called reverse Yankee deals is €40bn as of May 9th, 2025. This year’s issuance compares with the €30bn of euro bonds that had been issued by US companies by May last year.

Why Do US Firms Issue Reverse Yankees?

Lower Borrowing Costs

Eurozone interest rates have been lower than US rates for much of the past decade.

US companies can take advantage of cheaper euro funding costs.

Diversification of Investor Base

US firms can tap European institutional investors, broadening their investor base.

Natural Hedging

If a US company has revenues, operations, or acquisitions in Europe, issuing euro debt can match liabilities to euro cash flows, reducing currency risk.

Favorable Currency Conditions

Firms may use derivatives to hedge exchange rate risk, or even speculate if they expect the euro to weaken or strengthen in ways that benefit their financing.

Examples of Reverse Yankees

US tech giants like Apple, Microsoft, and IBM have all issued euro-denominated bonds in recent years to take advantage of low eurozone interest rates.

After the ECB launched QE and pushed rates negative (2015–2021), Reverse Yankees surged in popularity.

Risks:

Currency mismatch if revenues aren't in euros.

Hedging costs can rise depending on FX market volatility.

Regulatory or market access constraints in Europe.

When US companies issue Reverse Yankee deals at a record pace, several significant implications emerge for FX markets, particularly for EUR/USD dynamics:

Immediate FX Market Effects

EUR/USD Appreciation Pressure

When US companies issue euro-denominated bonds, they typically convert the euros they raise back to dollars for their operational needs

This creates immediate demand for USD and selling pressure on EUR

The conversion process typically involves FX swaps or outright spot transactions.

Cross-Currency Basis Swap Distortion

Increased hedging activity widens the cross-currency basis swap spread

As more US issuers swap euro liabilities back to dollars, the EUR/USD basis tends to become more negative

This makes it more expensive for European entities to swap into dollars while making it cheaper for US entities to swap into euros.

USD would generally strengthen (and EUR weaken) if US companies continue flocking to euro debt markets through Reverse Yankee deals.

Here's the typical mechanics that drive this effect:

A US company issues euro-denominated bonds in Europe

The company receives euros from European investors

Since the company primarily needs dollars for its U.S. operations, it then converts these euros to dollars

This creates increased buying pressure on USD and selling pressure on EUR

A crucial counterbalance in the Reverse Yankee equation is currency hedging costs that can significantly diminish or even eliminate the interest rate advantage that draws US companies to euro-denominated debt markets.

Here's how this dynamic works:

US companies are initially attracted by lower euro interest rates compared to dollar rates.

However, if the company needs dollars for U.S. operations, it must hedge the currency risk of having euro-denominated liabilities while generating dollar revenues.

The hedging typically occurs through cross-currency basis swaps, where:

The US company pays USD LIBOR/SOFR

The US company receives EURIBOR

Plus/minus a "basis spread"

The basis spread reflects supply and demand imbalances in currency hedging markets and can substantially increase hedging costs.

When the basis spread widens (becomes more negative for EUR/USD), it directly increases the all-in cost of the hedged euro borrowing.

The actual cost advantage calculation is therefore:

True borrowing cost = Euro interest rate + Currency hedging cost

If hedging costs rise enough, the initial interest rate advantage disappears entirely, potentially making domestic dollar issuance more economical again.

Bottomline

Even though these bonds are liabilities of foreign (US) entities, they show up as capital inflows into the euro area.

This can mask underlying current account weaknesses by boosting the capital account.

Implication:

FX market participants may overestimate euro strength based on capital flows, not trade fundamentals.

Creates the illusion of robust euro demand.