Rethinking Global Imbalances: It’s not about Savings

A Misleading Policy Message by the IMF

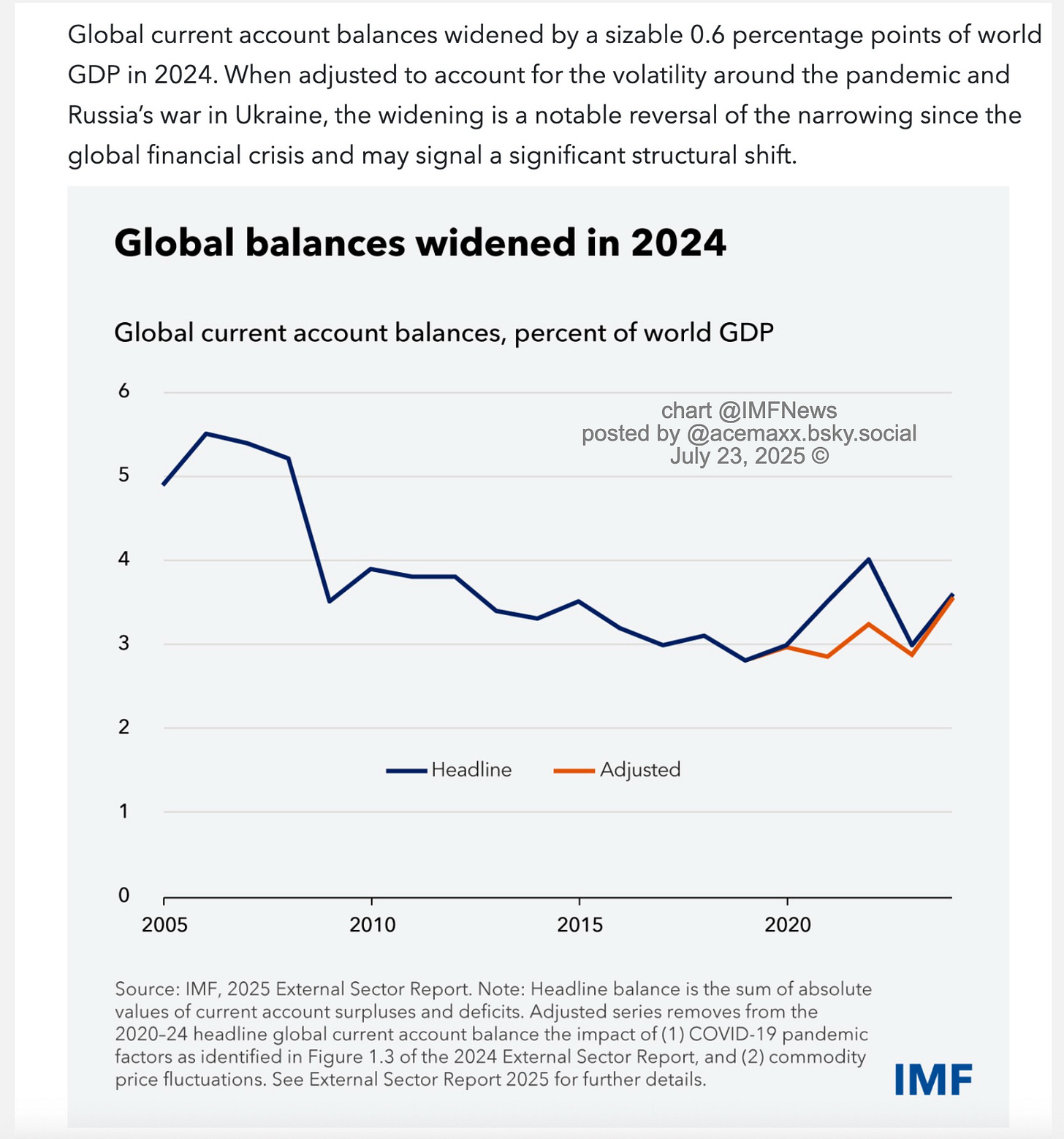

The IMF’s July 2025 report warns that global current account imbalances are widening again - a valid concern. But the IMF continues to frame these imbalances through a conventional lens: that growing economies should borrow foreign savings to invest, while aging economies must save more.

This "savings-fund-investment" narrative (neoclassical “loanable funds” view) is outdated.

In reality, modern economies are credit-driven, not savings-constrained. Investment doesn’t wait for savings - it creates savings through income generation. Banks lend based on creditworthiness and expected returns, not because someone else has saved first.

So attributing trade imbalances to “too much or too little saving” misses the point. It risks putting all the adjustment pressure on deficit countries while ignoring structural drivers like corporate surpluses, central bank policies, and FX flows.

If we want smarter, fairer solutions to global imbalances, we need to leave behind the idea that savings fund investment, and start recognizing how money, credit, and production really interact.

Bottom Line

The IMF’s framing risks sending the wrong message to policymakers - especially in surplus countries. If high saving is always portrayed as prudent, and deficits as inherently dangerous, then global adjustment falls disproportionately on debtor nations. It also downplays the role of corporate surpluses, financialization, and central bank policy in driving global imbalances.

Note: International trade is determined by absolute advantages and disadvantages; there are no comparative advantages that could be utilised by developing countries.

Heiner Flassbeck, the former chief economist of UNCTAD, writes in his recently published book (must-read) that most undesirable developments are caused by the fact that, in one way or another, real revaluations and devaluations occur that can no longer be borne by the countries concerned at reasonable cost.

The final solution therefore concerns the currency issue: to install a system where there are no real exchange rate changes from the outset. Why do we need real exchange rate changes at all?