Liquidationism as a Zombie Idea

(Oh boy!) Short-term pain for Long-term gain?

On Monday, I was watching Bloomberg TV.

RBC Capital Markets Head of US Equity Strategies told in a live talk that “short-term pain is necessary for long-term gain”.

I don’t like this term as it is a kind of “philosophy” that involves making sacrifices or enduring hardship now to achieve greater rewards in the future.

It reminds me of “liquidationism” in the 1930s: “liquidate labor, liquidate stocks, liquidate the farmers …” etc.

So, what gives?

The phrase “short-term pain for long-term gain” is more than a market cliché:

it encapsulates a recurring moralized view of economic adjustment, one that periodically resurfaces in financial and policy discourse — usually when elites want to justify austerity or tight monetary policy.

Let’s take a closer look at what’s really going on here:

The Approach Behind “Short-Term Pain”

When strategists or policymakers use that phrase, they’re invoking a kind of economic puritanism — the idea that suffering (recession, layoffs, market corrections) cleanses past excesses and restores “discipline.”

It assumes the economy, like an organism, must purge itself of “imbalances” before healthy growth can resume.

That was precisely the logic of liquidationism in the early 1930s.

Treasury Secretary Andrew Mellon famously urged Hoover to “liquidate labor, liquidate stocks, liquidate the farmers,” believing that bankruptcy and unemployment would force the economy to reset to a more “productive” equilibrium.

We know how that turned out — the policy deepened and prolonged the Great Depression.

The Modern Revival (2010–2011)

After the 2008 crisis, the BIS and parts of the ECB revived a similar idea.

They argued that monetary stimulus and fiscal expansion only delayed the necessary “structural adjustment”:

“Unemployment is high because workers have the wrong skills — not because demand is weak.”

This “structural” narrative justified austerity and premature rate hikes. But it rested on a fallacy: economies weren’t misaligned — they were demand-constrained.

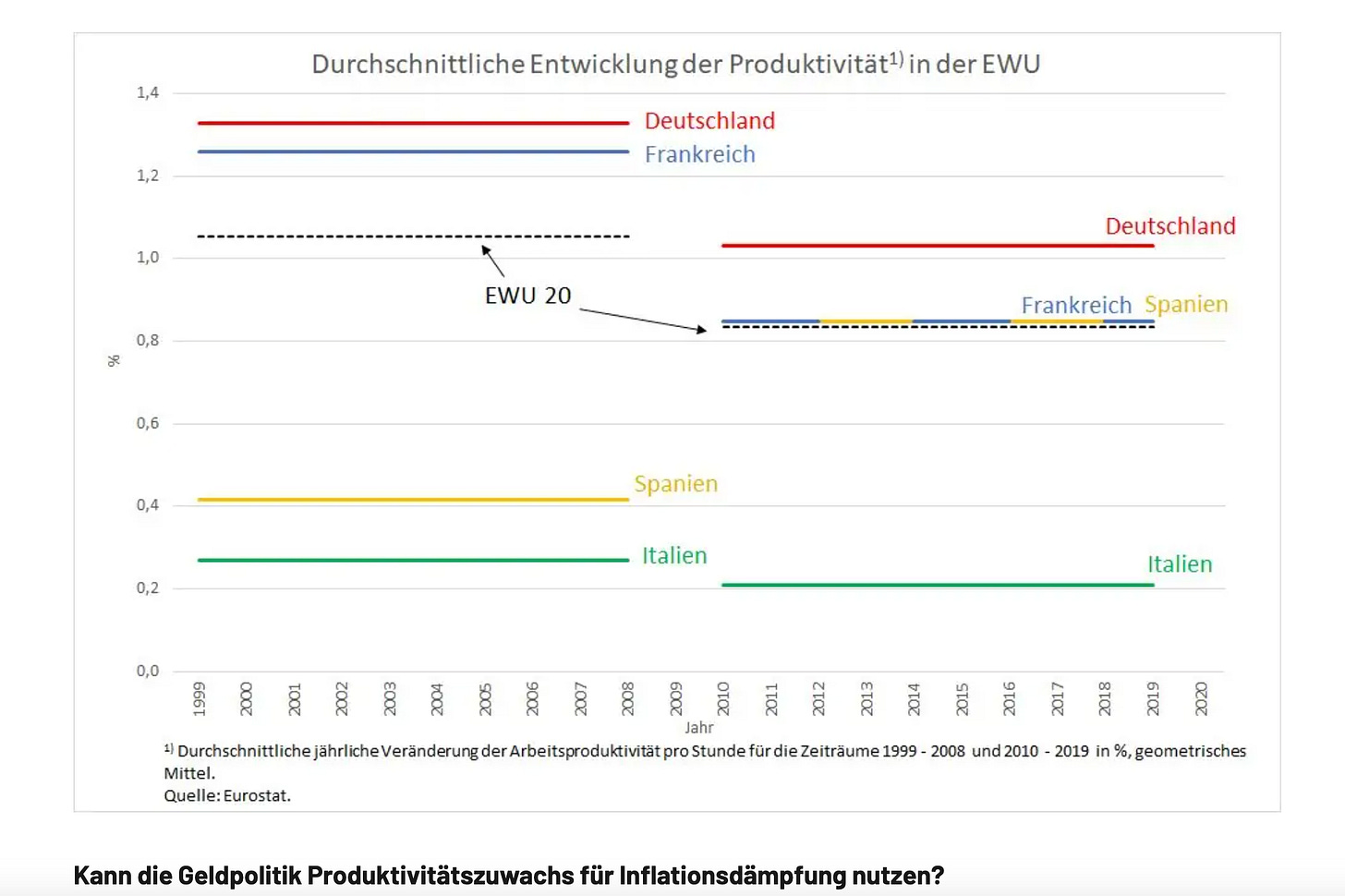

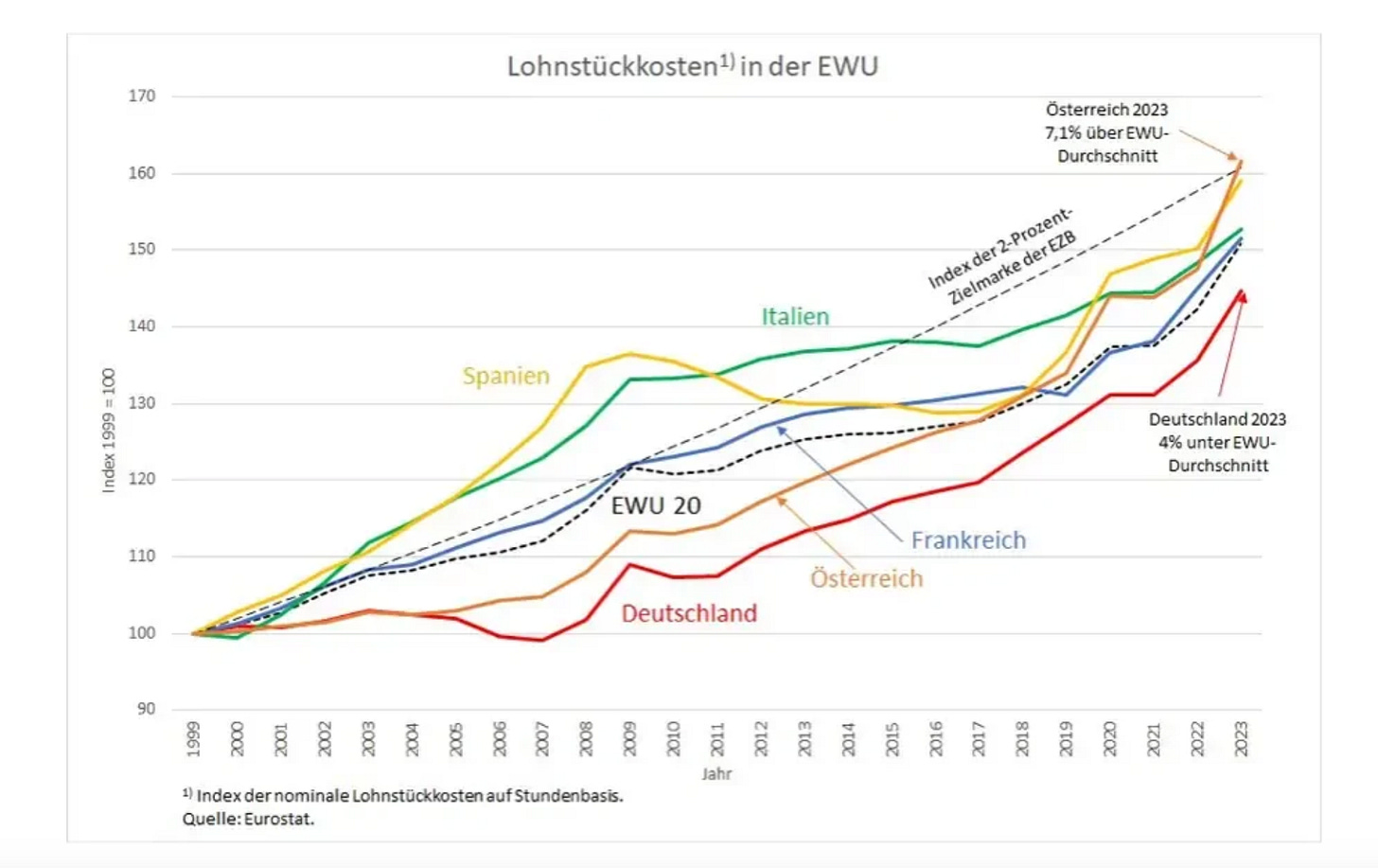

The result was years of output gaps, weak investment, and below-target inflation across Europe.

The 2020s Version

Now, post-COVID, the same rhetoric is resurfacing under new labels:

“Short-term pain” = tolerate higher rates, slower growth, and layoffs.

“Long-term gain” = a supposedly healthier, less speculative economy.

But again, it assumes that inflation or asset bubbles stem primarily from moral or behavioral excess — rather than from the structure of monetary-fiscal coordination, supply shocks, or global price dynamics.

It’s a convenient narrative for central banks and market strategists because it transfers the burden of adjustment onto workers and households — not onto policy design or corporate pricing power.

The Empirical Record

Historically, “short-term pain” policies rarely deliver “long-term gain.”

Instead, they often leave economies:

With permanently lower potential output,

Weaker wage growth, and

Political backlash against technocratic institutions.

Japan’s 1990s austerity and the eurozone’s 2010s stagnation are textbook examples.

What Really Helps Long-Term Growth

Enduring prosperity typically follows from the opposite of liquidationism:

Stabilizing demand (through fiscal and monetary support),

Encouraging investment (public and private), and

Preventing hysteresis (the scarring of human and physical capital during recessions).

Short-term stabilization and long-term growth aren’t trade-offs — they’re complements.