Household Analogy – Fallacy of Composition

Stop Running the Country Like a Household

Politicians and pundits love to say governments should “live within their means” - like a household tightening its belt. But this analogy, while intuitive, is dangerously wrong. Countries are not households, and running them like one leads to economic disaster.

A sovereign government - one that issues its own currency - is not constrained like a family or business. Households must earn before they spend. Governments can spend first and tax later. They are the monopoly issuer of money, not just users of it.

Trying to cut public spending in a downturn, as households do, only worsens the recession. Why? Because one person’s spending is another person’s income. If everyone cuts back at the same time - households, businesses, and government - demand collapses. This is the paradox of thrift, and it leads to layoffs, lost income, and bigger deficits down the road.

Keynes was right: in a recession, the government must step in and spend when others won’t. That’s not irresponsibility - it’s responsibility. Once growth returns, budget surpluses can follow naturally. But austerity in a slump is self-defeating.

The household analogy may win political points, but it makes for bad economics and worse policy. It’s time to retire it, before it does more damage.

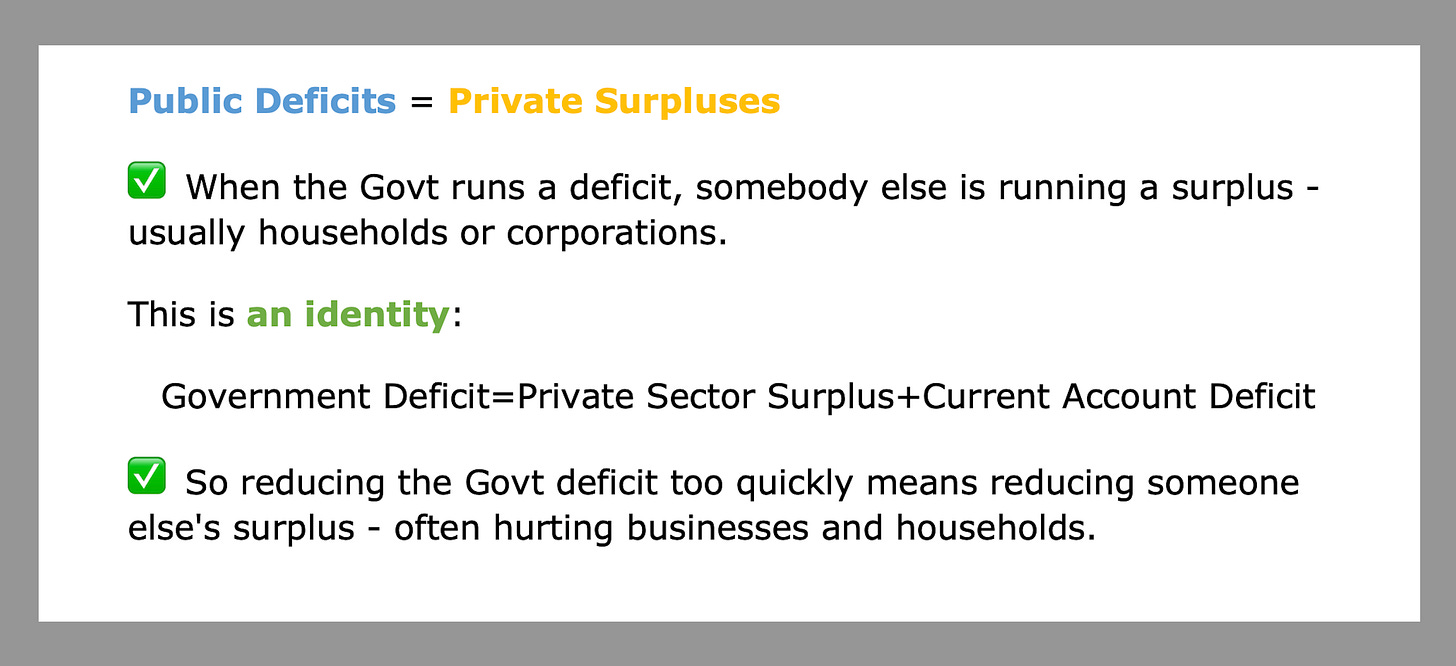

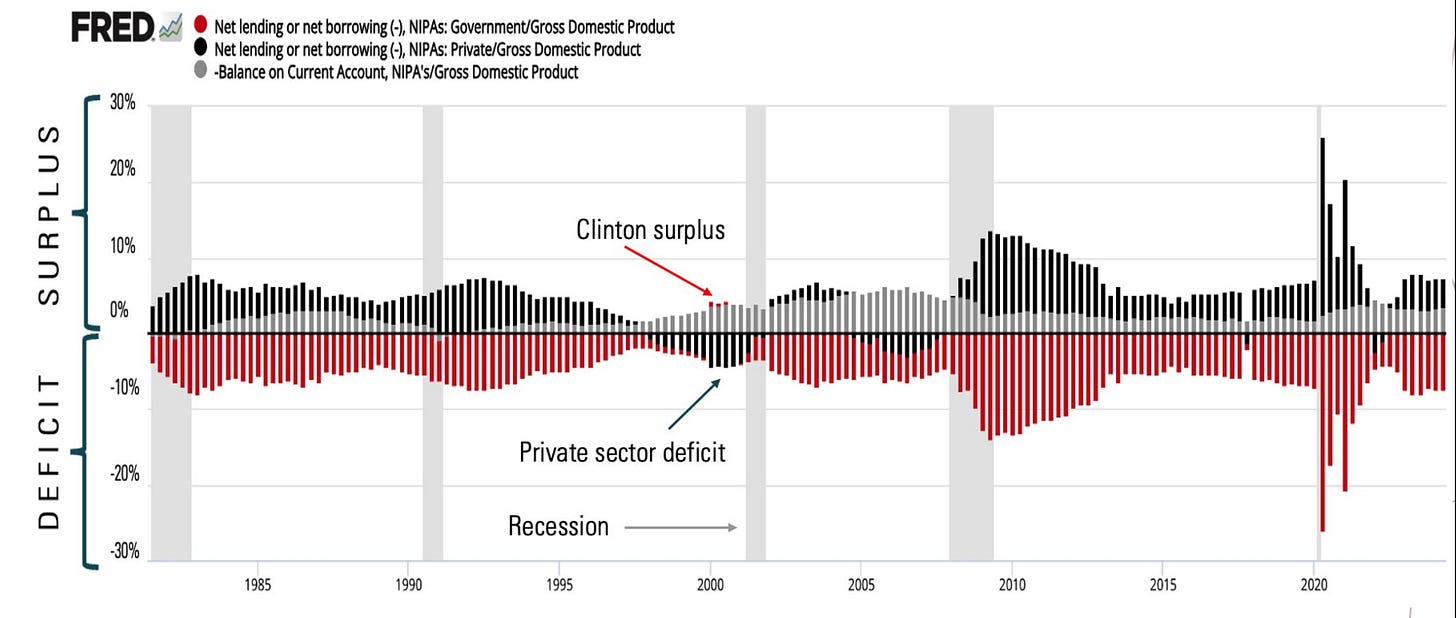

Net lending and borrowing always sum to zero - which emphasizes accounting rigor and avoids misleading narratives.

Deficits need not be bad if the private sector is accumulating savings. Persistent deficits or surpluses, however, can signal structural imbalances.