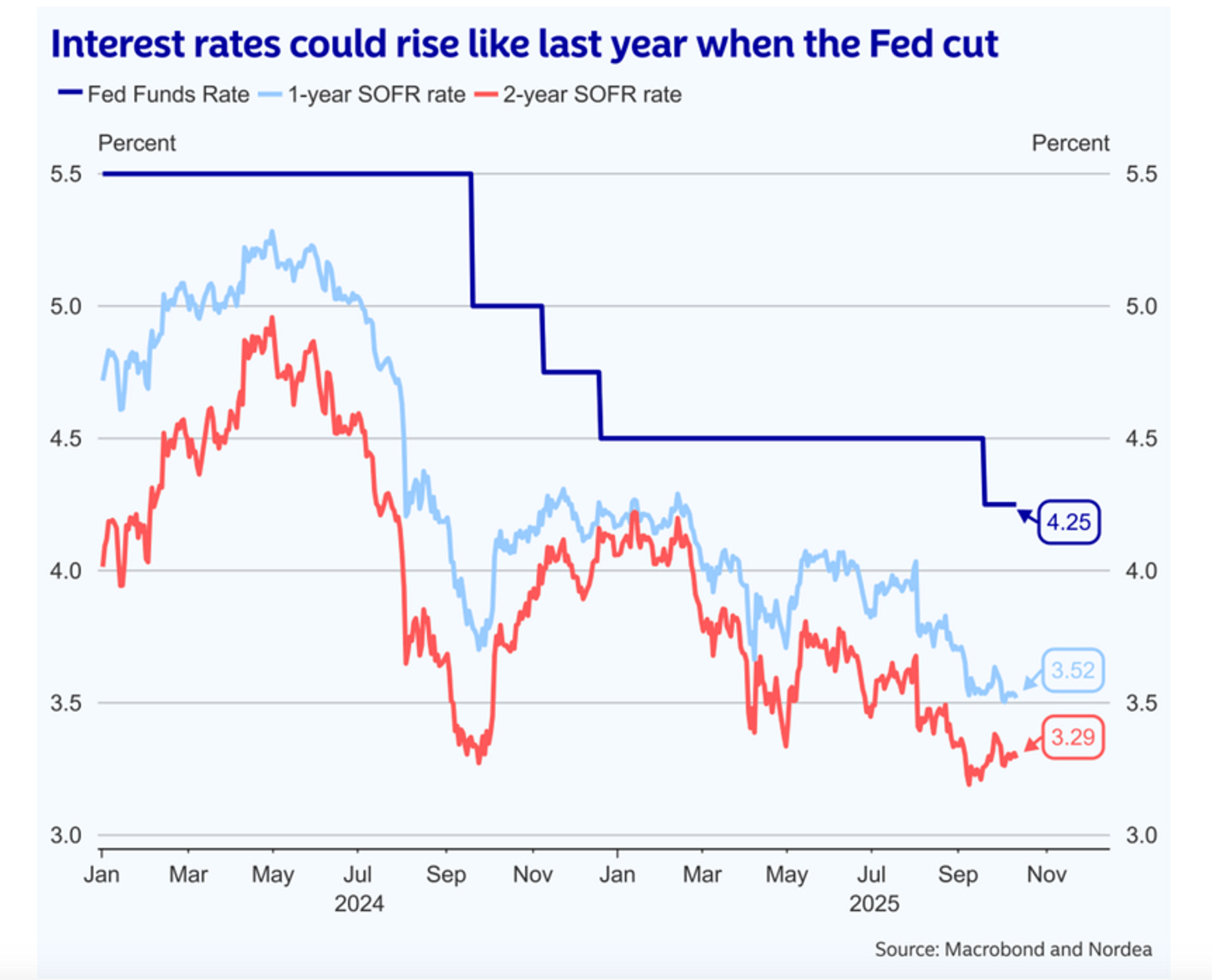

Nordea Bank Research Team delivers the following interesting chart which tells us a lot about how markets perceive the US economic and monetary outlook right now.

The constellation at a glance displays:

Fed funds rate: 4.25% → the current policy rate, set by the Fed.

1-year SOFR: 3.52%

2-year SOFR: 3.29%

That means short- and medium-term market rates are below the policy rate — the entire short end of the yield curve is inverted.

What inversion at the front end implies

When the market rates (SOFR, Treasury yields) are below the current Fed funds rate, investors are saying:

“We expect the Fed to cut rates over the next 12–24 months.”

That is, markets are pricing in monetary easing, reflecting expectations of:

Slower growth or mild recession,

Inflation continuing to decline, and

A gradual normalization of policy toward a lower neutral rate.

This inversion is a classic signal that the tightening phase is seen as over, and that policy may already be restrictive enough to slow the economy.

Nordea Bank points out that “interest rates could rise like last year when the Fed cut rates.”

That sounds paradoxical — why would rates rise after a cut?

They’re referring to market yields, not the policy rate. Here’s the logic:

When the Fed cuts rates into a strong market, or if inflation fears revive, longer-term rates (like the 10y or 2y SOFR) can rise — because investors worry that easier policy will re-ignite inflation or sustain demand.

This happened in 2024: the Fed began cutting, but bond yields increased as growth and inflation proved resilient.

So Nordea is warning that the market’s current dovish pricing (SOFR < Fed funds) may be too optimistic: if the economy stays strong or inflation stalls above target, yields could snap back higher even as the Fed eases.

Putting it together

Current curve (4.25% → 3.29%) → Markets foresee a sequence of rate cuts (roughly 100 bps+) within 2 years.

The same over-eagerness to price cuts existed before, and when reality proved more inflation-resilient, yields rose sharply despite Fed easing.

Implication →

The market believes inflation will continue falling and growth will slow.

But some analysts (Nordea among them) warn the opposite risk: if the economy holds up, today’s low forward rates may be unsustainable — setting up potential upward pressure on yields again.

Bottom line

This constellation tells us that:

Monetary policy is tight relative to market expectations.

Markets are pricing cuts, perhaps too confidently.

Nordea’s comment reflects skepticism: history shows yields can rise after rate cuts if cuts come amid lingering inflation or resilient growth.

In short:

The curve says “recession and disinflation ahead.”

“Not so fast — the 2024 pattern could repeat if inflation doesn’t truly dissipate.”