Germany’s Fiscal Spending Eases Credit Default Swaps

A Reflation Engine versus “Bond-Vigilantes”

For the past 5 years, Germany’s economy has been stagnant, growing by just 0.1% since 2019. Over the same period, the US economy has grown by 12%.

Why?

Germany’s recent economic underperformance - growing just 0.1% since 2019 - marks a dramatic shift for a country long seen as Europe’s export-driven engine.

The reasons are structural, cyclical, and geopolitical.

1. Let’s call it «export model fatigue»:

Germany’s economic model is heavily reliant on:

Manufacturing, especially autos, machinery, chemicals

Exports to China and the EU

A large current account surplus (≈7% of GDP)

But:

Global demand has weakened

China is rebalancing toward self-reliance

Supply chains have become more regionalized (less Germany-centric)

Germany is overexposed to a world that's de-globalizing.

2. Energy Shock Fallout

Germany was highly dependent on Russian gas, which was cheap and essential for:

Heavy industry (chemicals, steel, automotive)

Competitiveness in export pricing

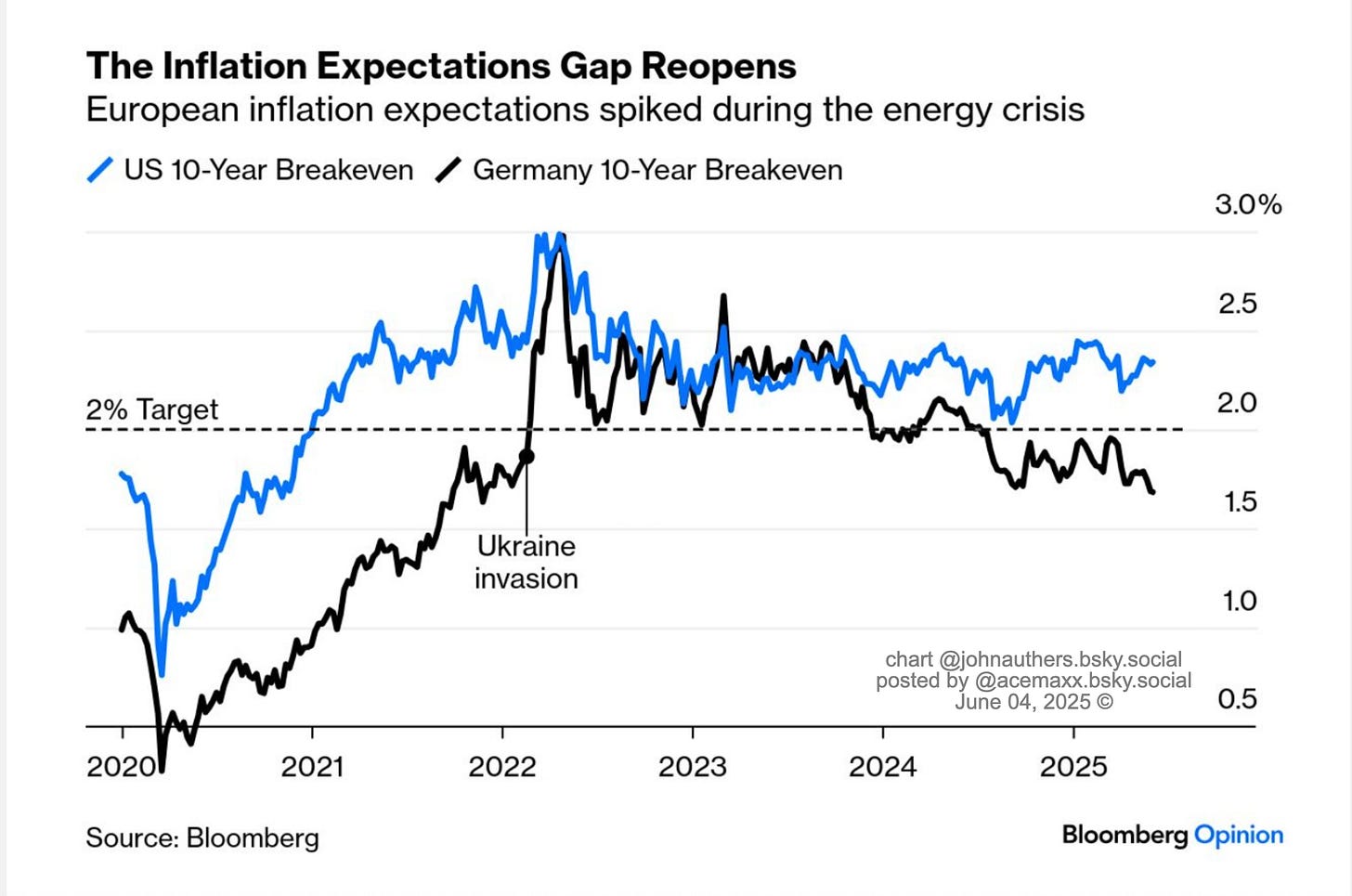

The war in Ukraine and the loss of cheap gas triggered:

Surging input costs

Factory slowdowns or relocations

Structural competitiveness loss

Energy cost is now a structural liability for German industry.

3. Outdated Fiscal Rules and Underinvestment

The “debt brake” (Schuldenbremse) limits public investment

Germany has historically preferred fiscal conservatism over stimulus

This has constrained growth even when:

Interest rates were ultra-low

Infrastructure was deteriorating

In the meantime, there is a shift:

Germany's new government plans a very large fiscal stimulus, which will boost military and infrastructure spending substantially: €1trillion over the next decade.

Caveat: The implication might take time.

Against this backdrop, it is not surprising that the 5y CDS for France, Italy and Spain are now easing, as can be clearly seen on the Reuters chart.

Germany is the largest economy in the eurozone. When it unleashes large-scale public spending — especially on military and infrastructure — it doesn't just stimulate its own economy. It:

Increases imports from eurozone partners (Spain, Italy, France, etc.)

Strengthens supply chains and subcontracting throughout the EU

Multiplies effects via private sector investment response

This is particularly important because Germany has run persistent current account surpluses, effectively "exporting demand and unemployment" for years.

As Germany spends more, demand rises for:

Machinery, energy infrastructure, materials, skilled labor

Services like logistics, consulting, digital systems, and defense tech

Countries like:

Italy and Spain, with slack labor markets and high youth unemployment,

France, with major industrial firms that supply Germany,

…will benefit from increased orders and cross-border contracts, stimulating job creation especially in tradable sectors.

Think of it as a "reflation engine" - especially helpful in southern Europe.

Here’s the key insight:

The debt-to-GDP ratios will improve, even without austerity.

When nominal GDP grows, the denominator of the debt-to-GDP ratio increases — even if public debt remains stable or rises moderately.

Assuming:

Fiscal stimulus raises real growth + inflation,

Tax revenues rise with stronger activity,

Employment improves and welfare outlays fall,

Then debt ratios stabilize or decline, without needing cuts in spending.

This dynamic helps highly indebted countries like Italy, where low growth has been the biggest problem — not overspending per se.

Bottomline:

Governments are not like households or companies. They can always get the money they need by issuing bonds: «animal spirits» overrule «Bond-Vigilantes».