Europe’s Tight Conditions - Tighter Thinking

Stagnation: Eurozone’ s «New» Shtick

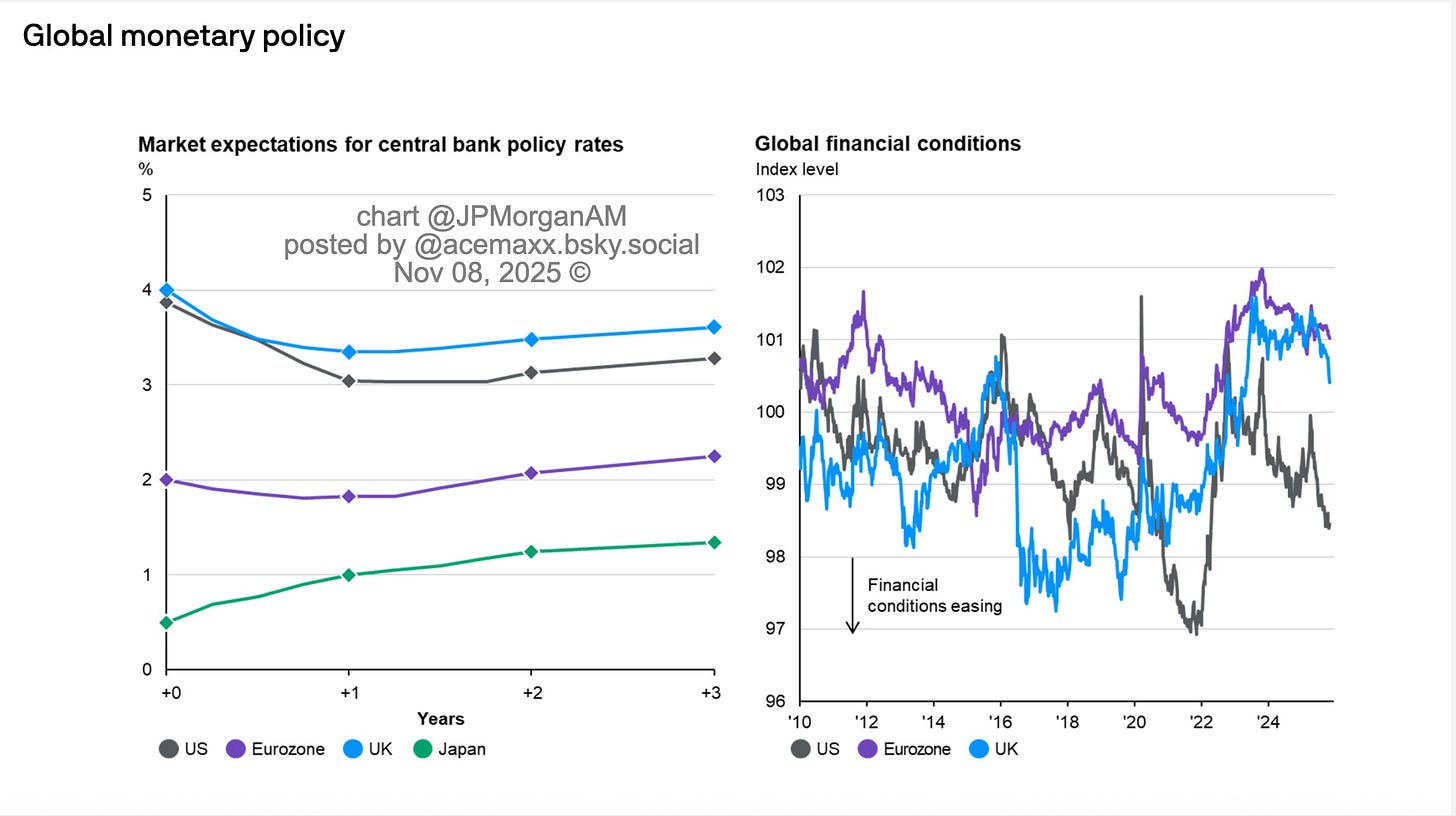

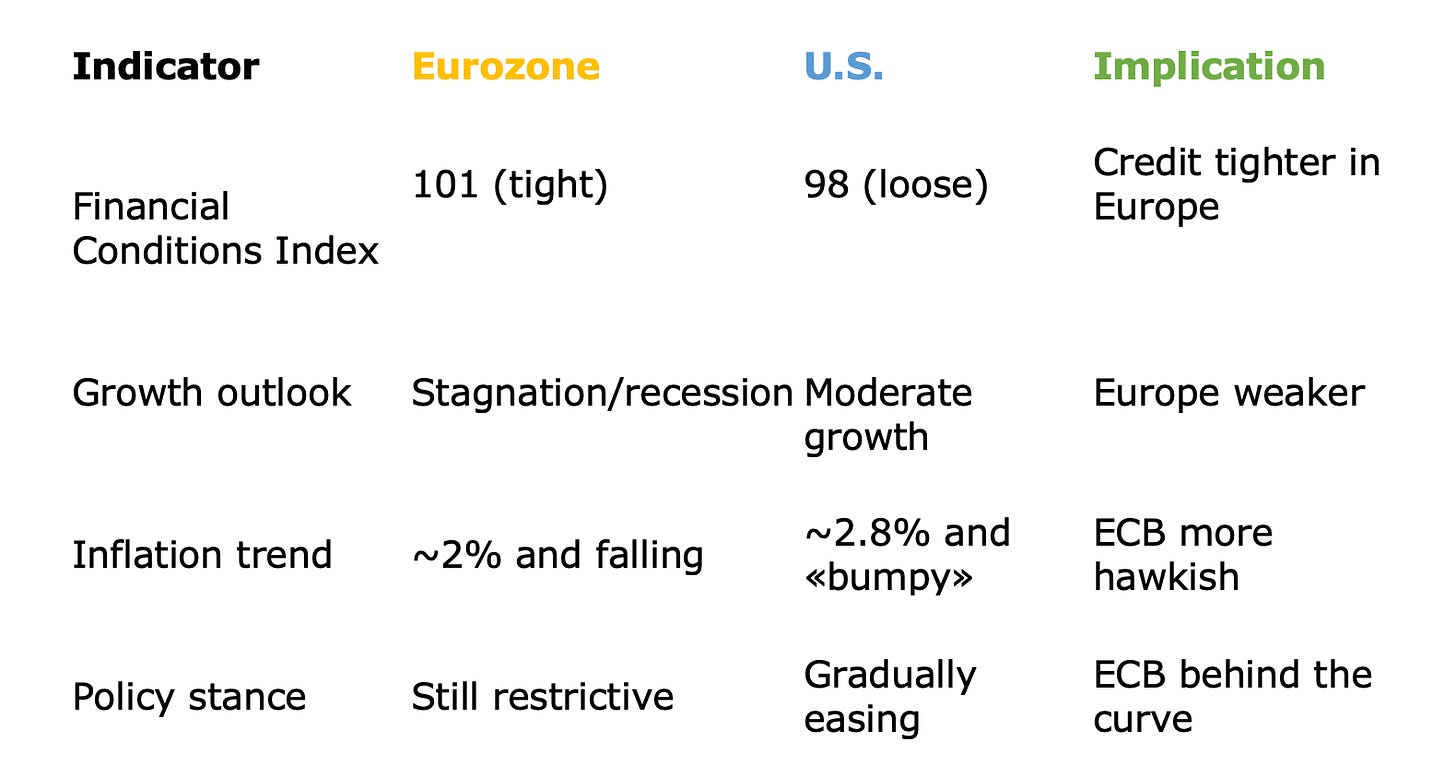

According to JPMorgan Asset Management, financial conditions in the euro area now stand at 101, compared with 98 in the U.S. — a technical way of saying that credit is already tighter in Europe than across the Atlantic.

Yet, paradoxically, the European Central Bank (ECB) continues to sound hawkish, insisting on “vigilance” against inflation that has, by most measures, already been tamed.

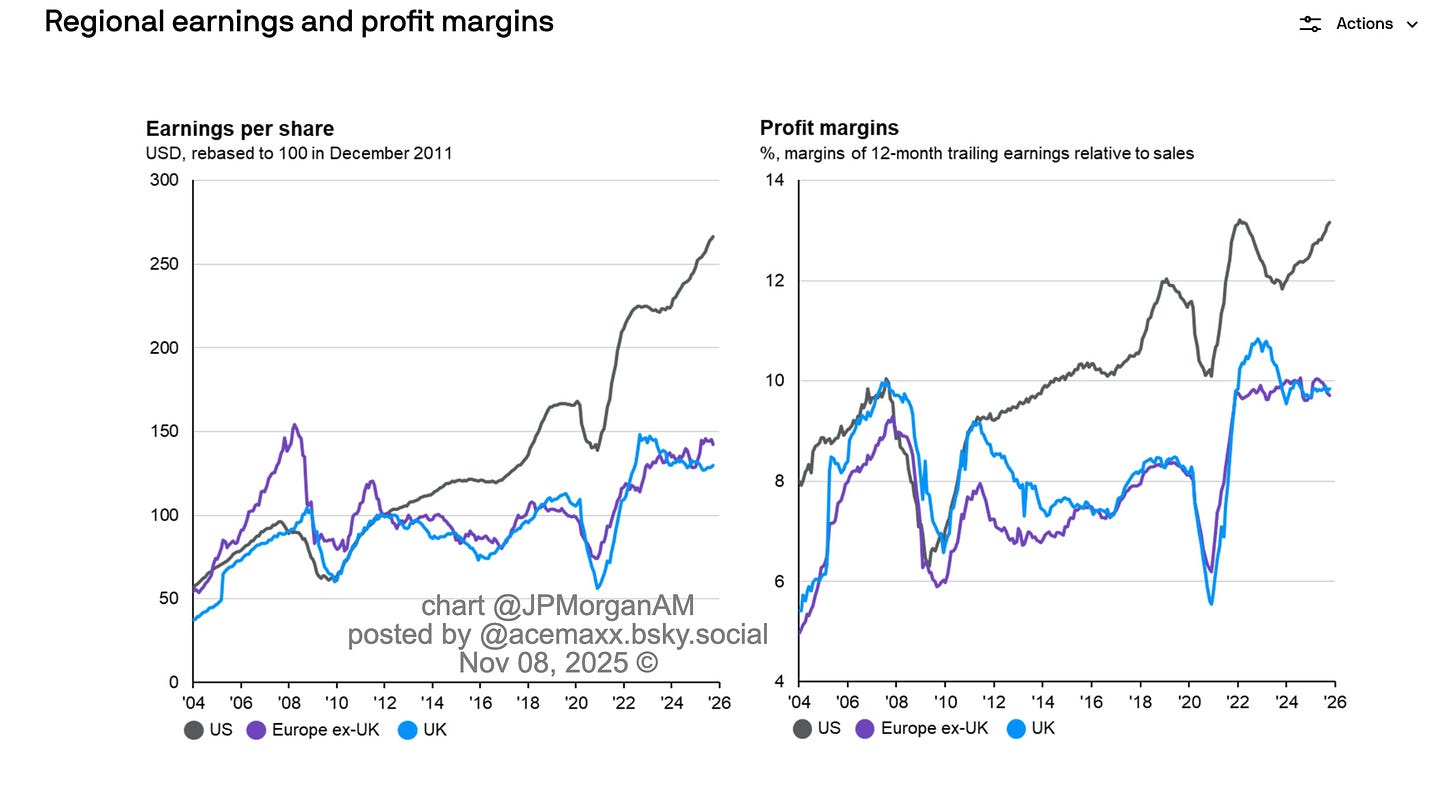

The contrast could hardly be starker. The U.S. economy, still expanding at a healthy pace, enjoys looser financial conditions and a more flexible policy stance. Meanwhile, the euro area — and Germany in particular — remains trapped in its longest recession since reunification.

And still, policymakers in Frankfurt and Brussels prefer to speak of supply shocks and structural reforms, as though red tape were the real reason why industrial output keeps shrinking and households have stopped spending.

It’s the familiar European reflex: when demand collapses, invoke “competitiveness.” When credit dries up, complain about “bureaucracy.” And when the economy sinks into stagnation, blame energy prices or geopolitics — never policy design.

The reality is simpler, if less convenient: financial conditions in Europe are already doing the ECB’s tightening for it. Bond yields are elevated, credit growth is near zero, and investment is frozen. In that environment, every hawkish speech only tightens the screws further.

As the Fed manages cycles, the ECB seems to manage credibility theater — determined to prove its anti-inflation virtue even if it means deepening the downturn.

For a continent still obsessed with moral discipline in economics, that may count as consistency. But it’s a consistency that risks turning the “longest recession” into something closer to Europe’s new normal.