Europe’s Mercantilism vs. New Tariffs as Trade Taxes

Why doesn’t America devalue US Dollar instead of applying tariffs on the rest of the world?

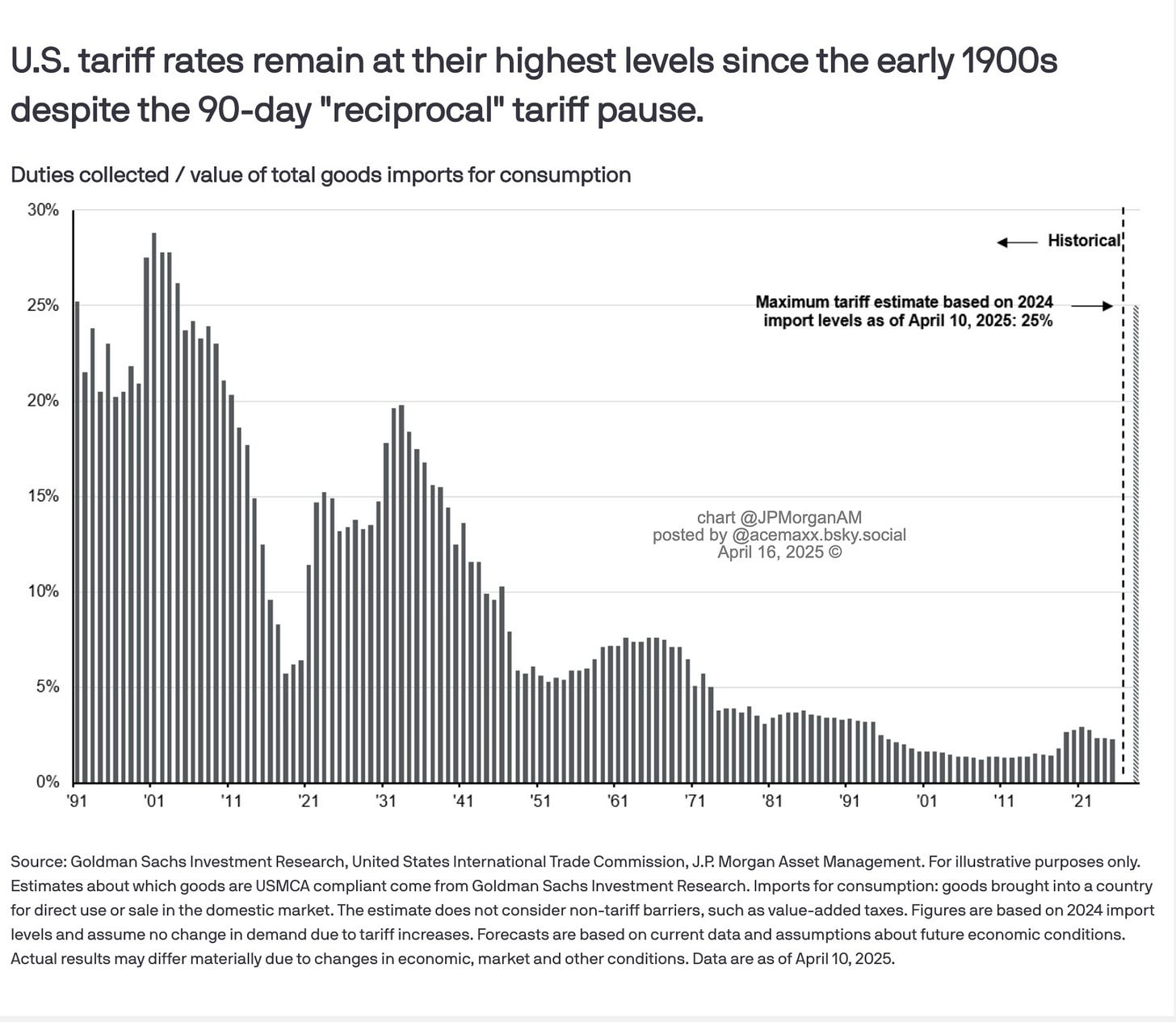

Effective tariffs (“trade taxes”) are still about 20% higher than at the start of the year.

Let it be understood: We are talking about the largest peacetime tax increase in US history.

Fed Chair Powell noted that US President Trump’s tariffs would raise inflation and lower economic growth. And tariffs could mean higher unemployment.

With this in mind, one important question is how much of the tariff will be passed directly to the US consumers?

Yet we need to ask ourselves - to start with - what Trump actually wants with new tariffs.

US President Trump claims that the USA is being treated unfairly by the rest of the world in trade relations.

He points to the US' high trade deficit and pledges less high «twin deficits» in the future.

The aim is to reduce the current account deficit by devaluing the US dollar. After all, tariff increases, when they take effect, are nothing other than a real devaluation. Right?

Via supply chains, the trade taxes will be adding to US consumers’ tax burden with levies on imported goods. In other words, American consumers will have to pay more if they continue to buy foreign goods.

This is the loss of purchasing power that the US government wants to achieve in relation to imported goods from other countries - in order to reduce the US trade deficit.

On top, the White House could also introduce export subsidies for American exporters. Then the picture would be complete. Politics in the US is in flux.

But the “tariff orgy” in conjunction with the attempt to maintain a strong dollar is definitely more than confusing, as Heiner Flassbeck puts it in his blog.

Let’s us remember: It was James Baker, the US Secretary of the Treasury in the 1980s, who, with the “Plaza Accord”, focused on devaluing the US dollar in order to get rid of the US current account deficit.

That would be a way in which no one would feel unfairly treated. In other words, bilateral sanctions via tariff increases could be avoided.

But how can Washington help to devalue the USD?

The president can declare that the US needs a real devaluation and instruct the Fed to weaken the dollar by buying foreign currency.

This is perfectly legit: case in point, the Swiss National Bank (SNB), which for several years in a row has fought tooth and nail against the undesirable appreciation of the Swiss franc. The SNB has bought foreign currency against Swiss francs on a massive scale, equities, government bonds and corporate debt. In other words, it sold CHF and purchased EUR, USD, GBP, JPY, etc.

Furthermore: currency traders would follow the White House's announcement and reduce their USD holdings, thus contributing to the dollar's weakness.

But Trump's advisors are getting bogged down in bilateral measures that are not effective, as Heiner Flassbeck further points out.

In short, a deficit with the rest of the world should be tackled globally.

Note:

If the Chinese government decided to significantly reduce its huge holdings of US government bonds, this would play directly into Trump's hands.

Beijing would then have to allow a stronger appreciation of its own currency, which it certainly does not want.

After all, China has the US Treasuries in its portfolio because it wanted to weaken its own currency in the past, by purchasing dollars.