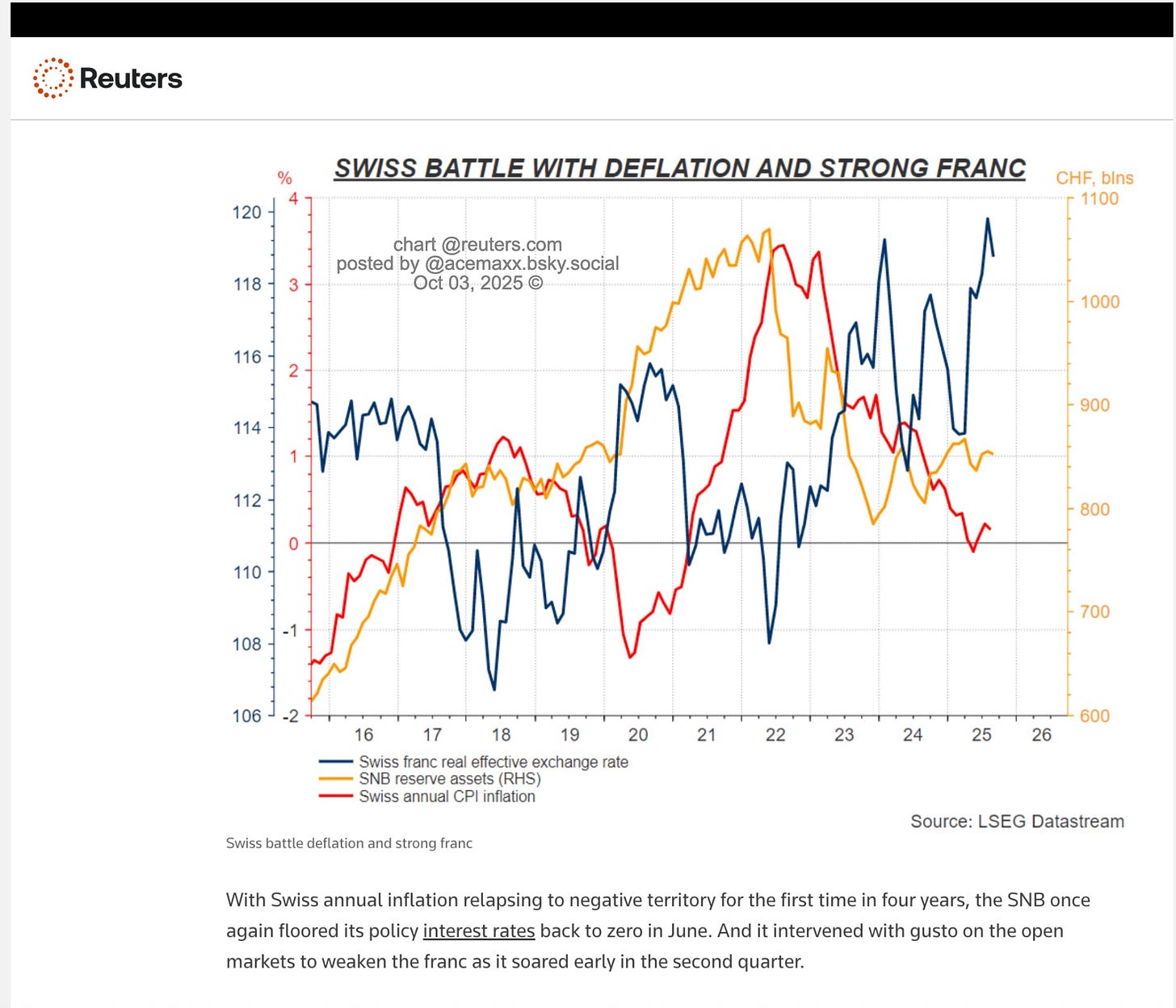

It is an open secret that deflation in Switzerland is a critical topic.

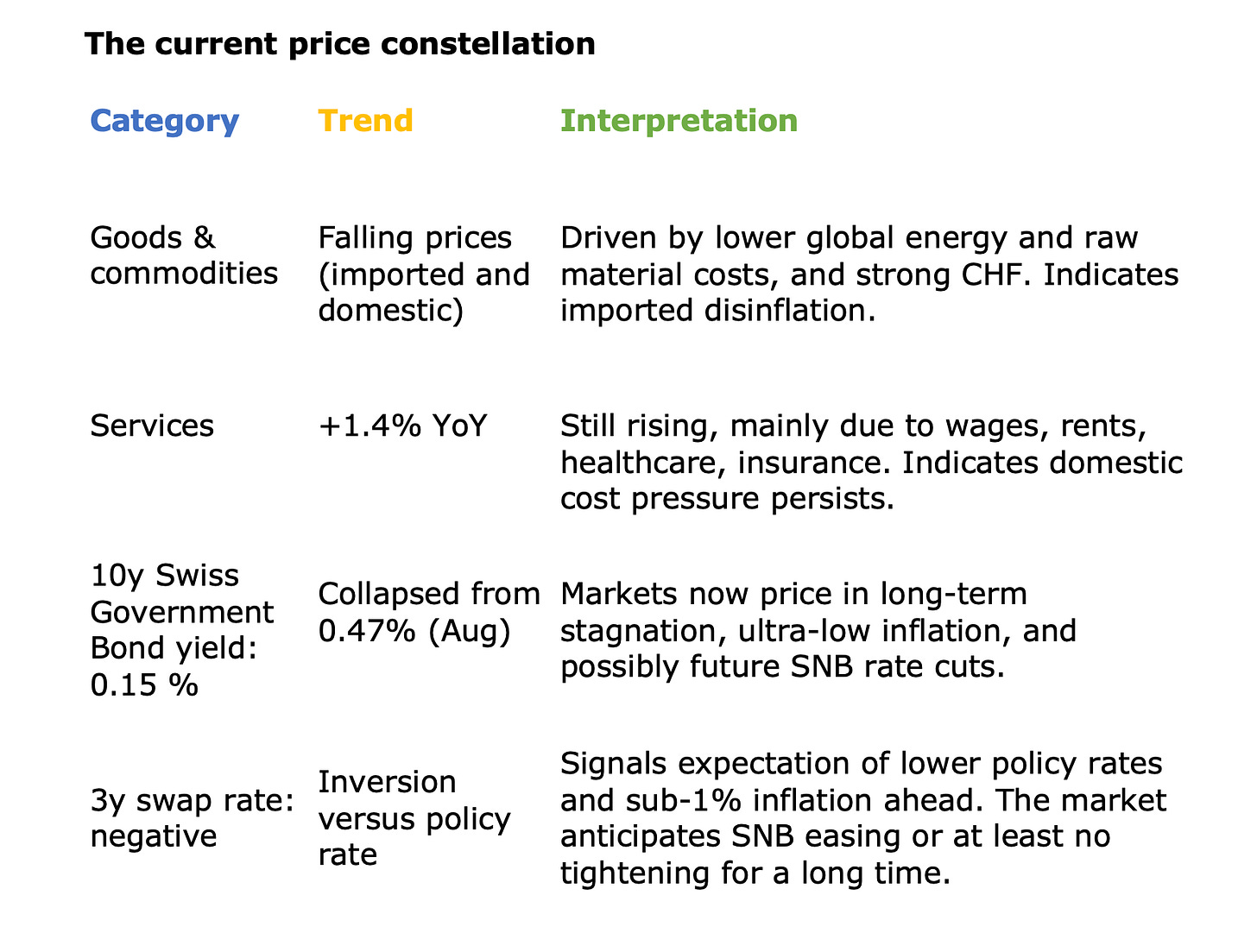

Yet it is interesting to observe that while goods and commodities are becoming cheaper, the prices of services are still rising at 1.4% (but below the SNB’s target).

And in the meantime, 10y Swiss Govt bond yields only 0.15%, compared with 0.47% in August.

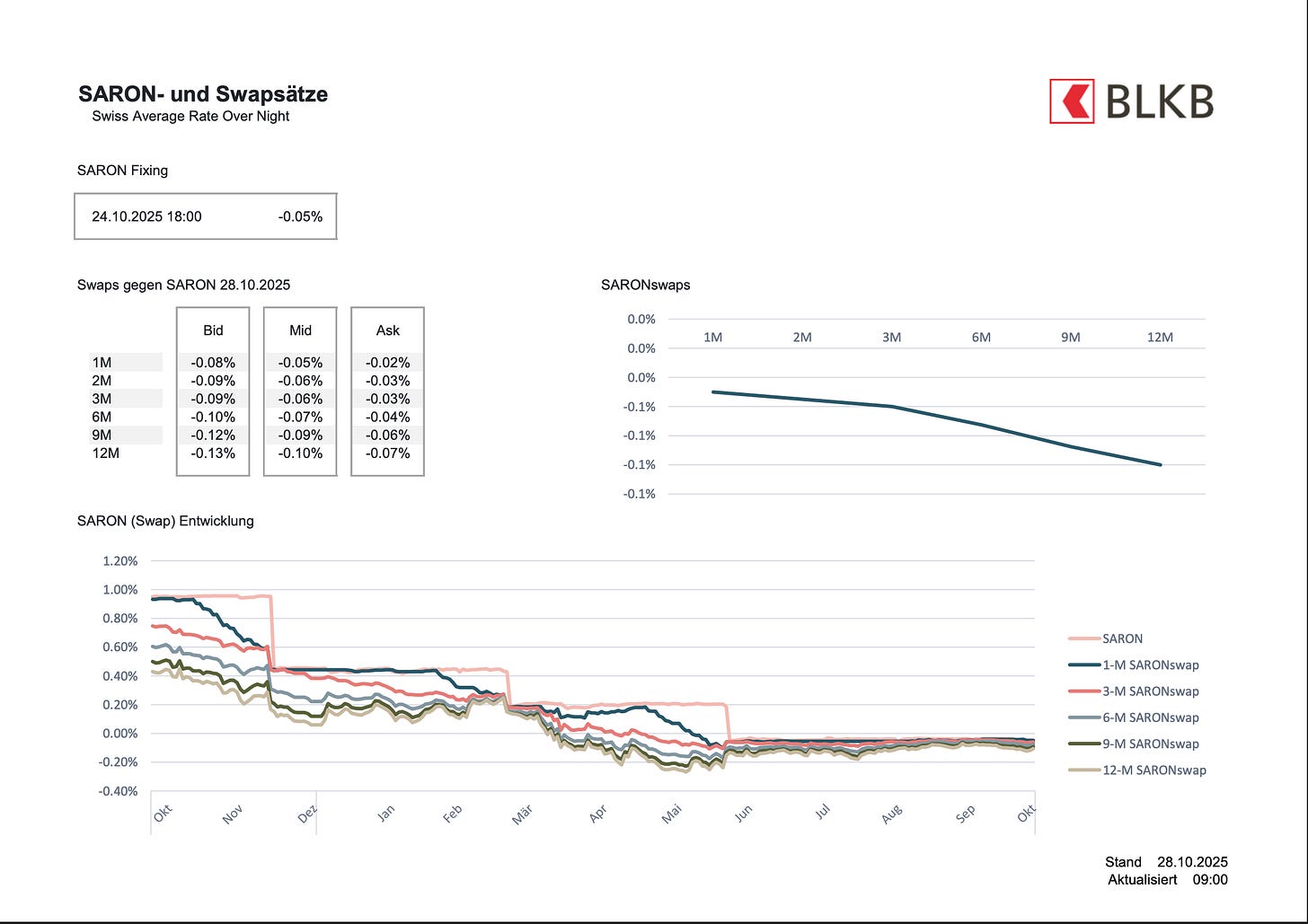

Yet, 3y swap rate is now also negative.

What to make of this data set in terms of a deflation danger in Switzerland?

Yes, Switzerland is flirting with deflationary dynamics, but the picture is subtle and layered.

It is essential to recall that Switzerland has long been prone to mild deflationary pressures due to:

A very strong franc (CHF) — suppresses import prices

A price-stable, low-growth domestic demand profile

And the SNB’s credibility anchoring inflation expectations extremely low

So, some degree of negative goods inflation is not new — but it’s the persistence and breadth that matter.

What this means economically

Falling goods prices are imported deflation: the CHF’s strength and weak global demand reduce tradable prices.

Service inflation shows that domestic demand has not yet collapsed; wage growth and administered prices (like healthcare premiums) are keeping headline CPI from going negative.

But if services inflation starts to fall, broad-based deflation could emerge — especially if households delay consumption expecting prices to fall further.

So far, Switzerland is in “lowflation,” not full deflation, but the risk vector points downward.

The bond and swap curve tell a consistent story:

Yields collapsing = strong demand for safety + low inflation expectations.

Negative short-end swaps = markets see the SNB possibly cutting rates again (currently 0.0 %) or staying lower for longer.

Flattened / inverted curve = expectation that monetary easing cannot re-ignite inflation quickly — classic Japanification signal.

Investors are effectively saying:

“We see long-term nominal growth in Switzerland at or below 1 %, inflation around 0 %, and no real rate pressure.”

Deflation becomes dangerous when:

Price declines become generalized beyond goods → services, wages, and rents.

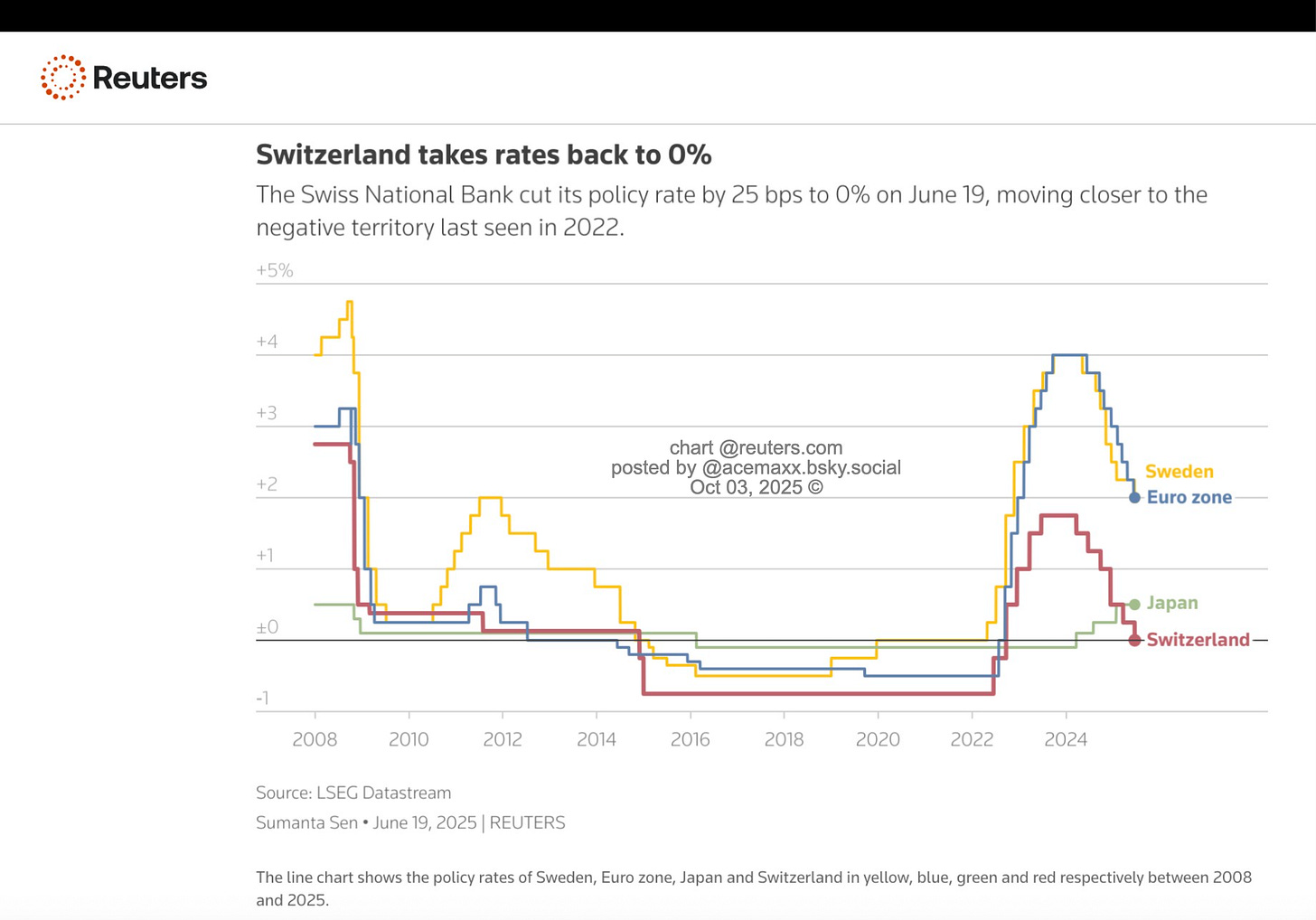

Nominal interest rates hit zero, limiting SNB’s policy room.

Households postpone spending → reinforcing downward price spiral.

Debt burdens rise in real terms.

Switzerland isn’t there yet, but the mix of:

A strong CHF

Weak external demand (especially from Germany)

Tight fiscal stance

Declining long-term yields means it is drifting closer to deflation territory than the eurozone or US.

Bottom Line

The SNB is expected to:

Reaffirm its readiness to intervene in FX markets if CHF appreciation intensifies.

Lower the policy rate slightly below zero again if disinflation accelerates.

Emphasize that persistent deflation would violate its price-stability mandate (0–2 % range).

They would rather accept a weaker franc than entrenched deflation.

In short:

Switzerland is not in full-blown deflation, but the preconditions are there — subdued growth, collapsing yields, negative swap rates, and imported price declines. The remaining inflation in services is the thin firewall preventing outright deflation.

If that firewall weakens — say, if wage growth stalls or the franc strengthens further — the SNB will likely have to act preemptively to avoid a deflation trap.